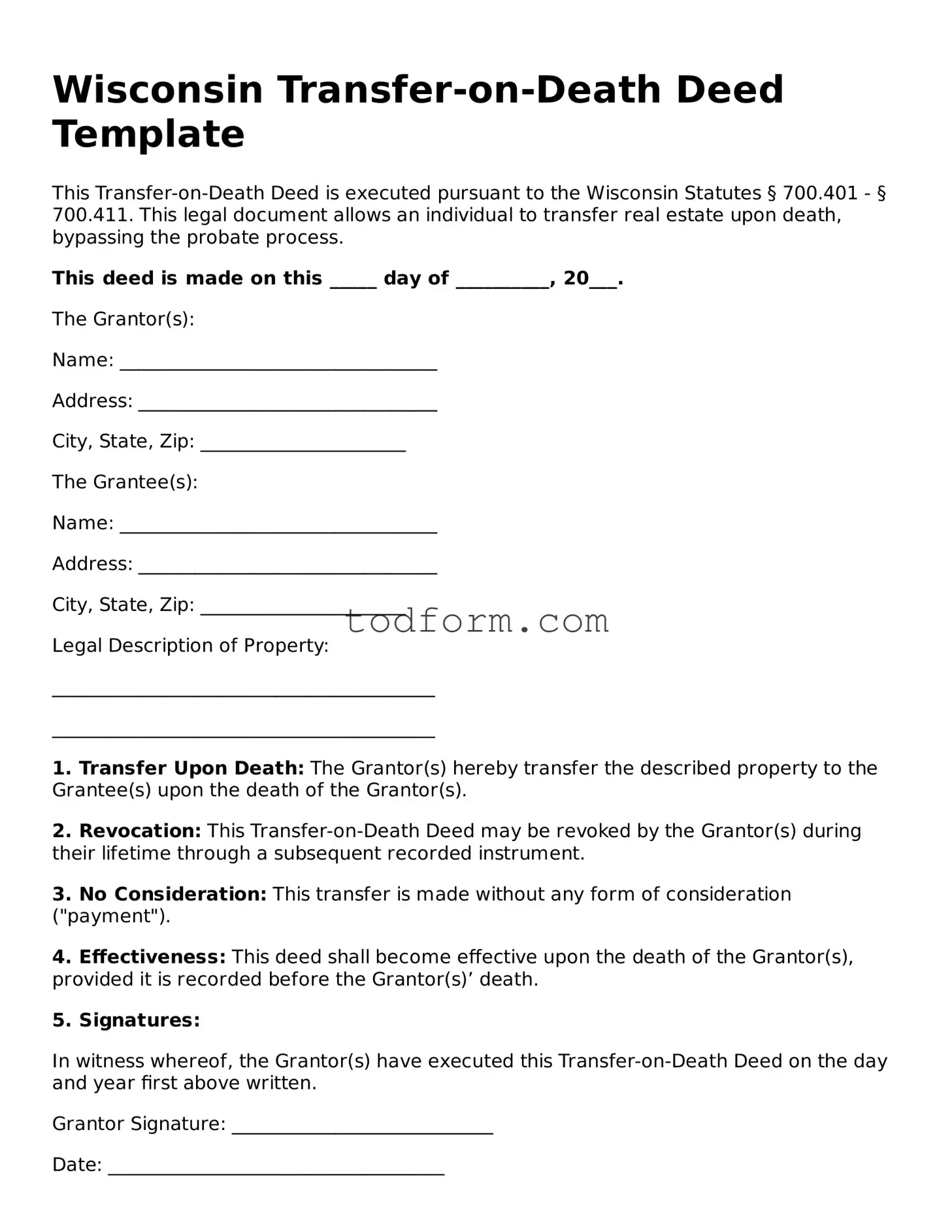

Wisconsin Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed pursuant to the Wisconsin Statutes § 700.401 - § 700.411. This legal document allows an individual to transfer real estate upon death, bypassing the probate process.

This deed is made on this _____ day of __________, 20___.

The Grantor(s):

Name: __________________________________

Address: ________________________________

City, State, Zip: ______________________

The Grantee(s):

Name: __________________________________

Address: ________________________________

City, State, Zip: ______________________

Legal Description of Property:

_________________________________________

_________________________________________

1. Transfer Upon Death: The Grantor(s) hereby transfer the described property to the Grantee(s) upon the death of the Grantor(s).

2. Revocation: This Transfer-on-Death Deed may be revoked by the Grantor(s) during their lifetime through a subsequent recorded instrument.

3. No Consideration: This transfer is made without any form of consideration ("payment").

4. Effectiveness: This deed shall become effective upon the death of the Grantor(s), provided it is recorded before the Grantor(s)’ death.

5. Signatures:

In witness whereof, the Grantor(s) have executed this Transfer-on-Death Deed on the day and year first above written.

Grantor Signature: ____________________________

Date: ____________________________________

Witness Signature: ___________________________

Date: ____________________________________

Notary Public:

State of Wisconsin

County of _________________________________

Subscribed and sworn to before me this _____ day of __________, 20___.

Notary Signature: __________________________

My Commission Expires: _____________________