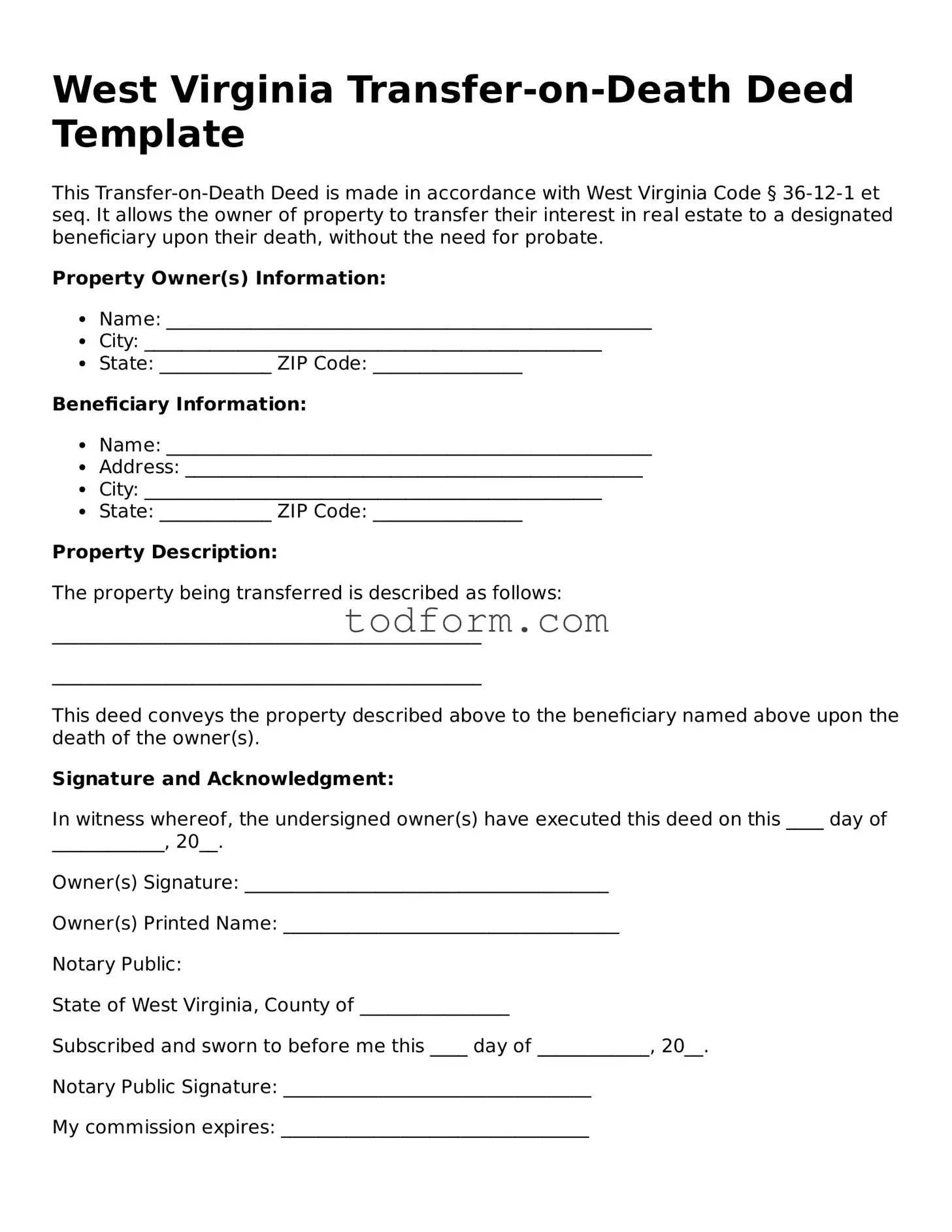

West Virginia Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made in accordance with West Virginia Code § 36-12-1 et seq. It allows the owner of property to transfer their interest in real estate to a designated beneficiary upon their death, without the need for probate.

Property Owner(s) Information:

- Name: ____________________________________________________

- City: _________________________________________________

- State: ____________ ZIP Code: ________________

Beneficiary Information:

- Name: ____________________________________________________

- Address: _________________________________________________

- City: _________________________________________________

- State: ____________ ZIP Code: ________________

Property Description:

The property being transferred is described as follows:

______________________________________________

______________________________________________

This deed conveys the property described above to the beneficiary named above upon the death of the owner(s).

Signature and Acknowledgment:

In witness whereof, the undersigned owner(s) have executed this deed on this ____ day of ____________, 20__.

Owner(s) Signature: _______________________________________

Owner(s) Printed Name: ____________________________________

Notary Public:

State of West Virginia, County of ________________

Subscribed and sworn to before me this ____ day of ____________, 20__.

Notary Public Signature: _________________________________

My commission expires: _________________________________