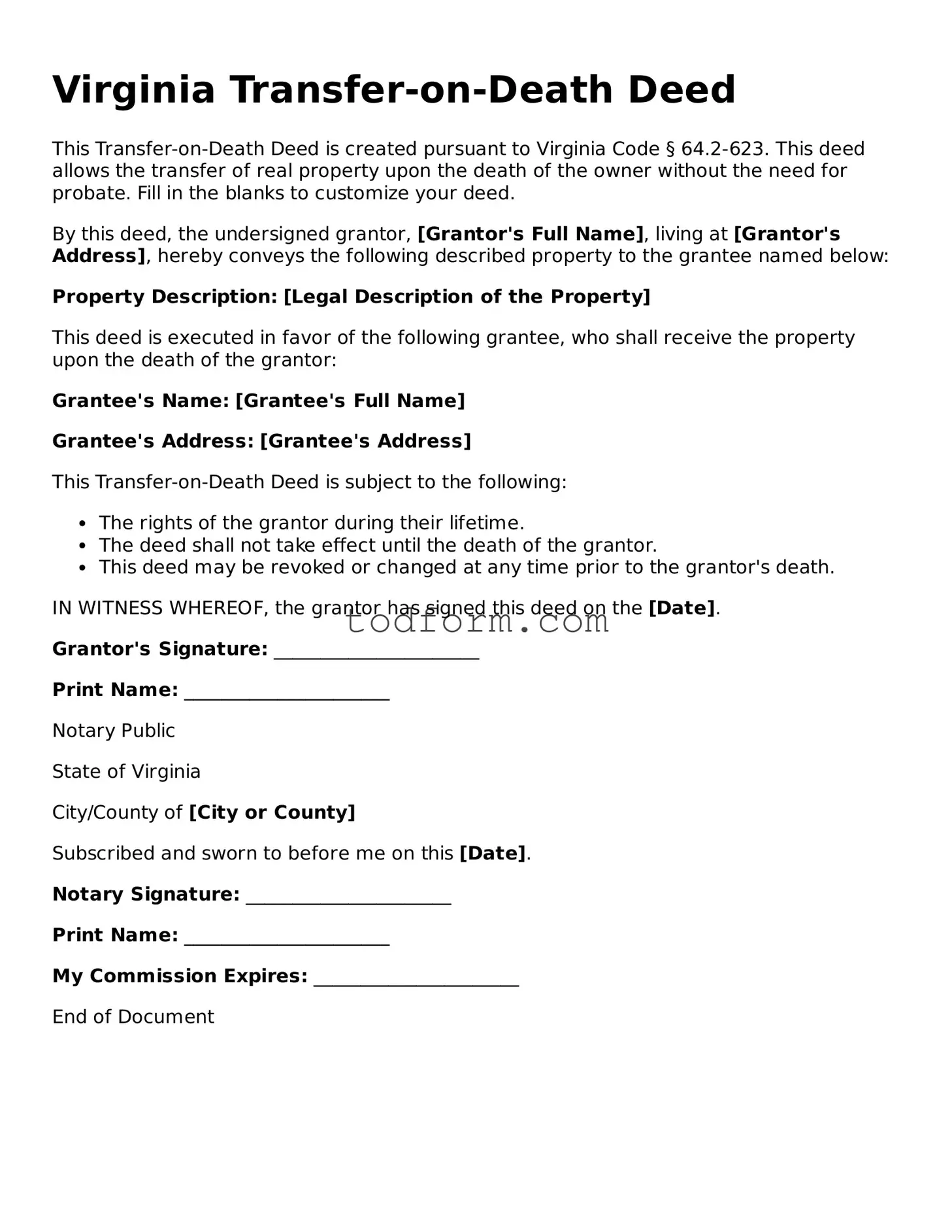

Virginia Transfer-on-Death Deed

This Transfer-on-Death Deed is created pursuant to Virginia Code § 64.2-623. This deed allows the transfer of real property upon the death of the owner without the need for probate. Fill in the blanks to customize your deed.

By this deed, the undersigned grantor, [Grantor's Full Name], living at [Grantor's Address], hereby conveys the following described property to the grantee named below:

Property Description: [Legal Description of the Property]

This deed is executed in favor of the following grantee, who shall receive the property upon the death of the grantor:

Grantee's Name: [Grantee's Full Name]

Grantee's Address: [Grantee's Address]

This Transfer-on-Death Deed is subject to the following:

- The rights of the grantor during their lifetime.

- The deed shall not take effect until the death of the grantor.

- This deed may be revoked or changed at any time prior to the grantor's death.

IN WITNESS WHEREOF, the grantor has signed this deed on the [Date].

Grantor's Signature: ______________________

Print Name: ______________________

Notary Public

State of Virginia

City/County of [City or County]

Subscribed and sworn to before me on this [Date].

Notary Signature: ______________________

Print Name: ______________________

My Commission Expires: ______________________

End of Document