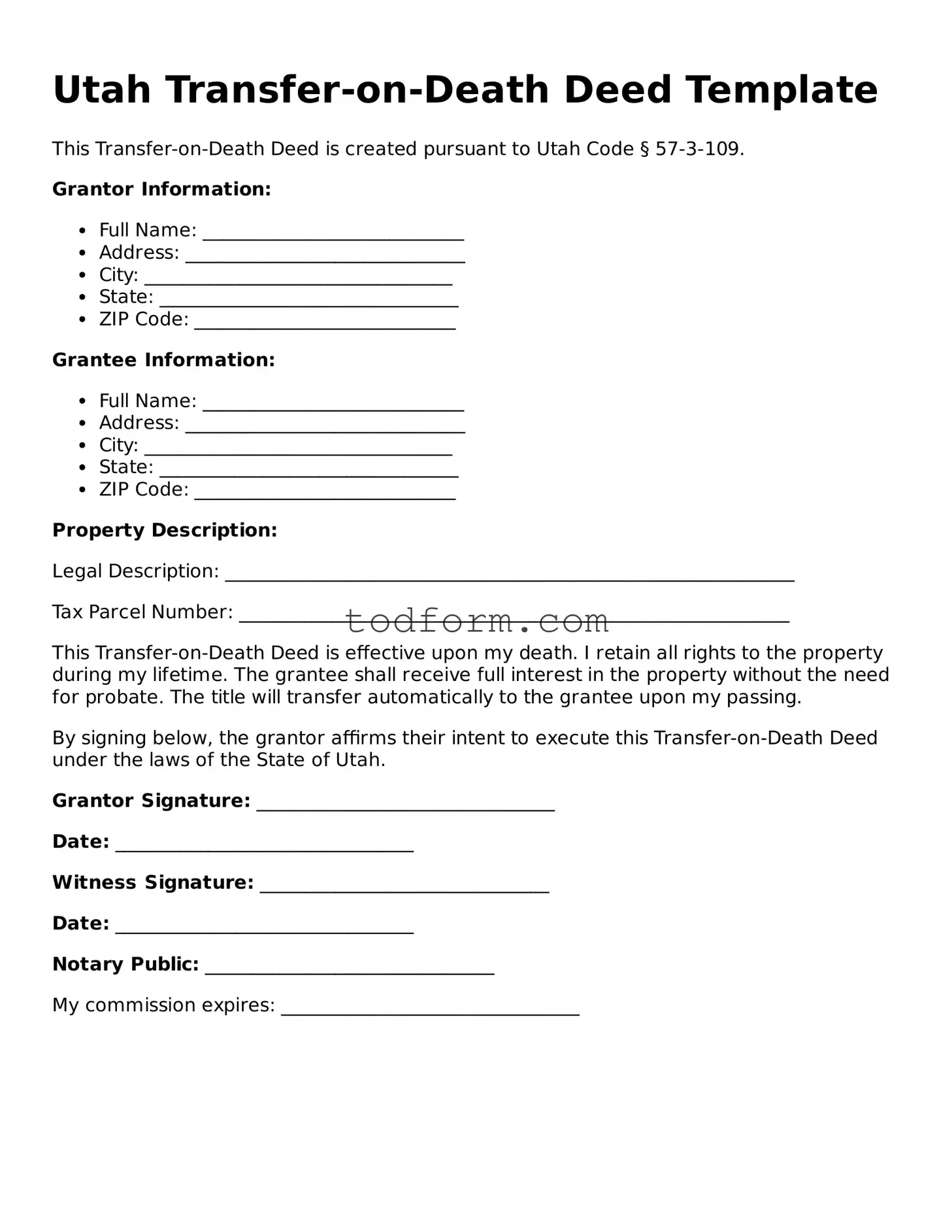

Utah Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created pursuant to Utah Code § 57-3-109.

Grantor Information:

- Full Name: ____________________________

- Address: ______________________________

- City: _________________________________

- State: ________________________________

- ZIP Code: ____________________________

Grantee Information:

- Full Name: ____________________________

- Address: ______________________________

- City: _________________________________

- State: ________________________________

- ZIP Code: ____________________________

Property Description:

Legal Description: _____________________________________________________________

Tax Parcel Number: ___________________________________________________________

This Transfer-on-Death Deed is effective upon my death. I retain all rights to the property during my lifetime. The grantee shall receive full interest in the property without the need for probate. The title will transfer automatically to the grantee upon my passing.

By signing below, the grantor affirms their intent to execute this Transfer-on-Death Deed under the laws of the State of Utah.

Grantor Signature: ________________________________

Date: ________________________________

Witness Signature: _______________________________

Date: ________________________________

Notary Public: _______________________________

My commission expires: ________________________________