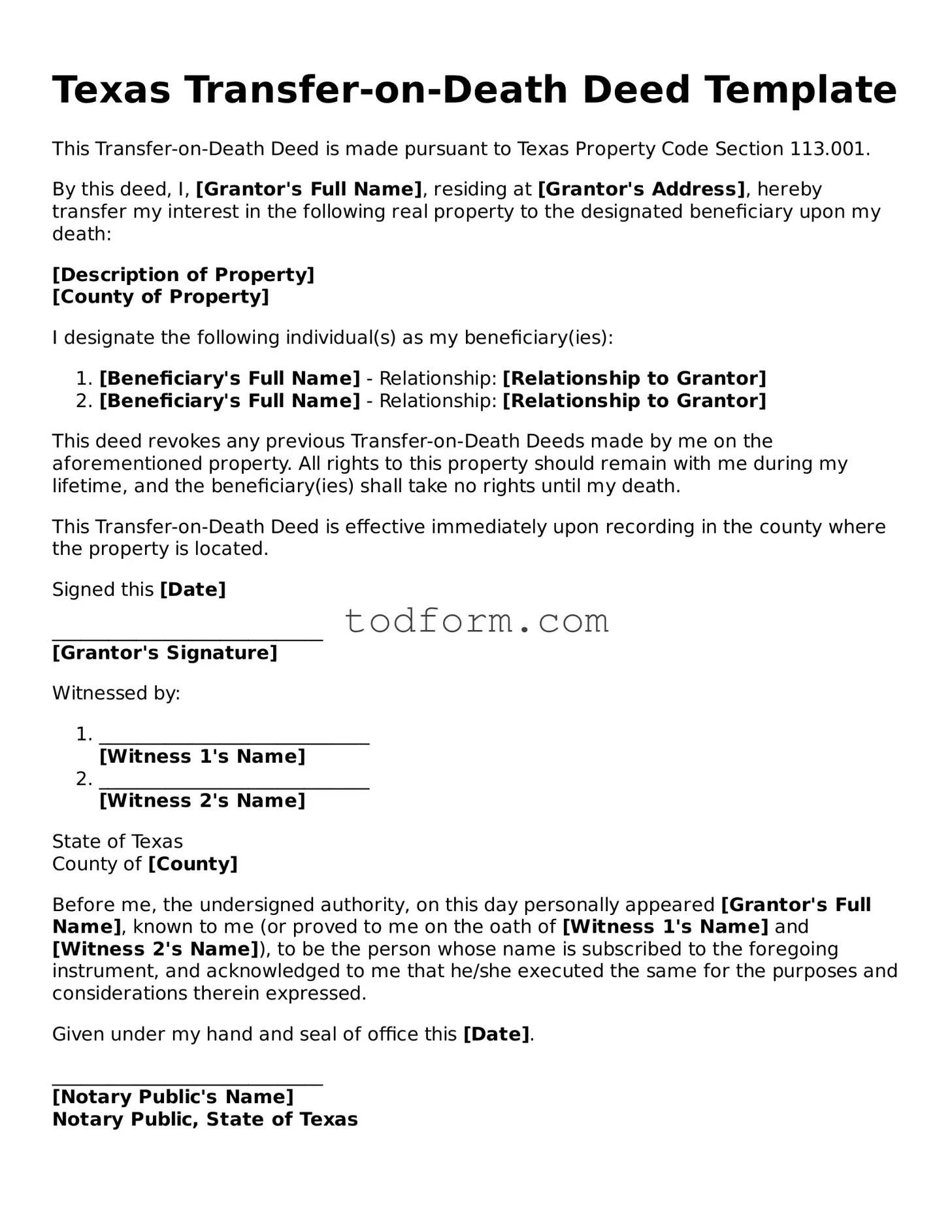

Texas Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to Texas Property Code Section 113.001.

By this deed, I, [Grantor's Full Name], residing at [Grantor's Address], hereby transfer my interest in the following real property to the designated beneficiary upon my death:

[Description of Property]

[County of Property]

I designate the following individual(s) as my beneficiary(ies):

- [Beneficiary's Full Name] - Relationship: [Relationship to Grantor]

- [Beneficiary's Full Name] - Relationship: [Relationship to Grantor]

This deed revokes any previous Transfer-on-Death Deeds made by me on the aforementioned property. All rights to this property should remain with me during my lifetime, and the beneficiary(ies) shall take no rights until my death.

This Transfer-on-Death Deed is effective immediately upon recording in the county where the property is located.

Signed this [Date]

_____________________________

[Grantor's Signature]

Witnessed by:

- _____________________________

[Witness 1's Name]

- _____________________________

[Witness 2's Name]

State of Texas

County of [County]

Before me, the undersigned authority, on this day personally appeared [Grantor's Full Name], known to me (or proved to me on the oath of [Witness 1's Name] and [Witness 2's Name]), to be the person whose name is subscribed to the foregoing instrument, and acknowledged to me that he/she executed the same for the purposes and considerations therein expressed.

Given under my hand and seal of office this [Date].

_____________________________

[Notary Public's Name]

Notary Public, State of Texas