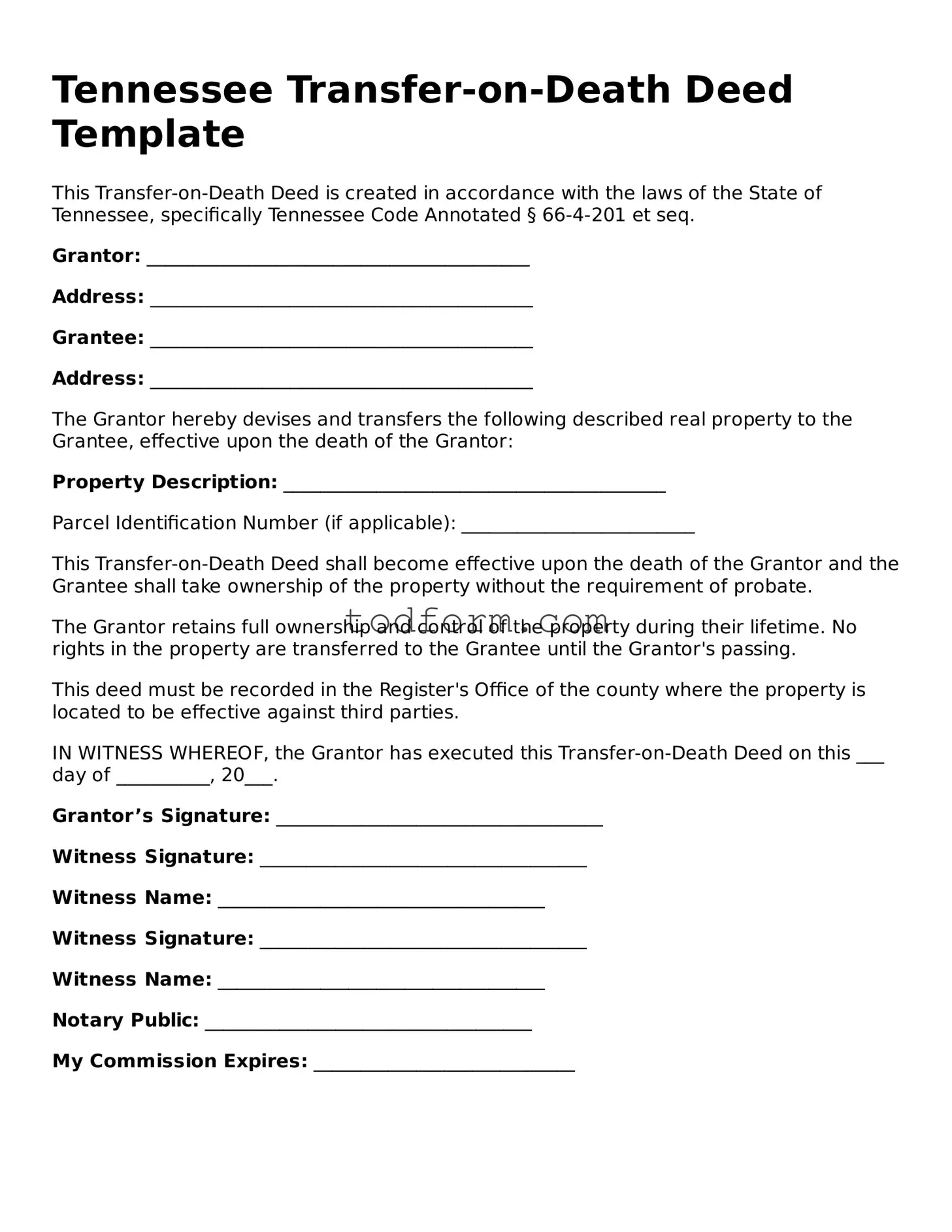

Tennessee Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created in accordance with the laws of the State of Tennessee, specifically Tennessee Code Annotated § 66-4-201 et seq.

Grantor: _________________________________________

Address: _________________________________________

Grantee: _________________________________________

Address: _________________________________________

The Grantor hereby devises and transfers the following described real property to the Grantee, effective upon the death of the Grantor:

Property Description: _________________________________________

Parcel Identification Number (if applicable): _________________________

This Transfer-on-Death Deed shall become effective upon the death of the Grantor and the Grantee shall take ownership of the property without the requirement of probate.

The Grantor retains full ownership and control of the property during their lifetime. No rights in the property are transferred to the Grantee until the Grantor's passing.

This deed must be recorded in the Register's Office of the county where the property is located to be effective against third parties.

IN WITNESS WHEREOF, the Grantor has executed this Transfer-on-Death Deed on this ___ day of __________, 20___.

Grantor’s Signature: ___________________________________

Witness Signature: ___________________________________

Witness Name: ___________________________________

Witness Signature: ___________________________________

Witness Name: ___________________________________

Notary Public: ___________________________________

My Commission Expires: ____________________________