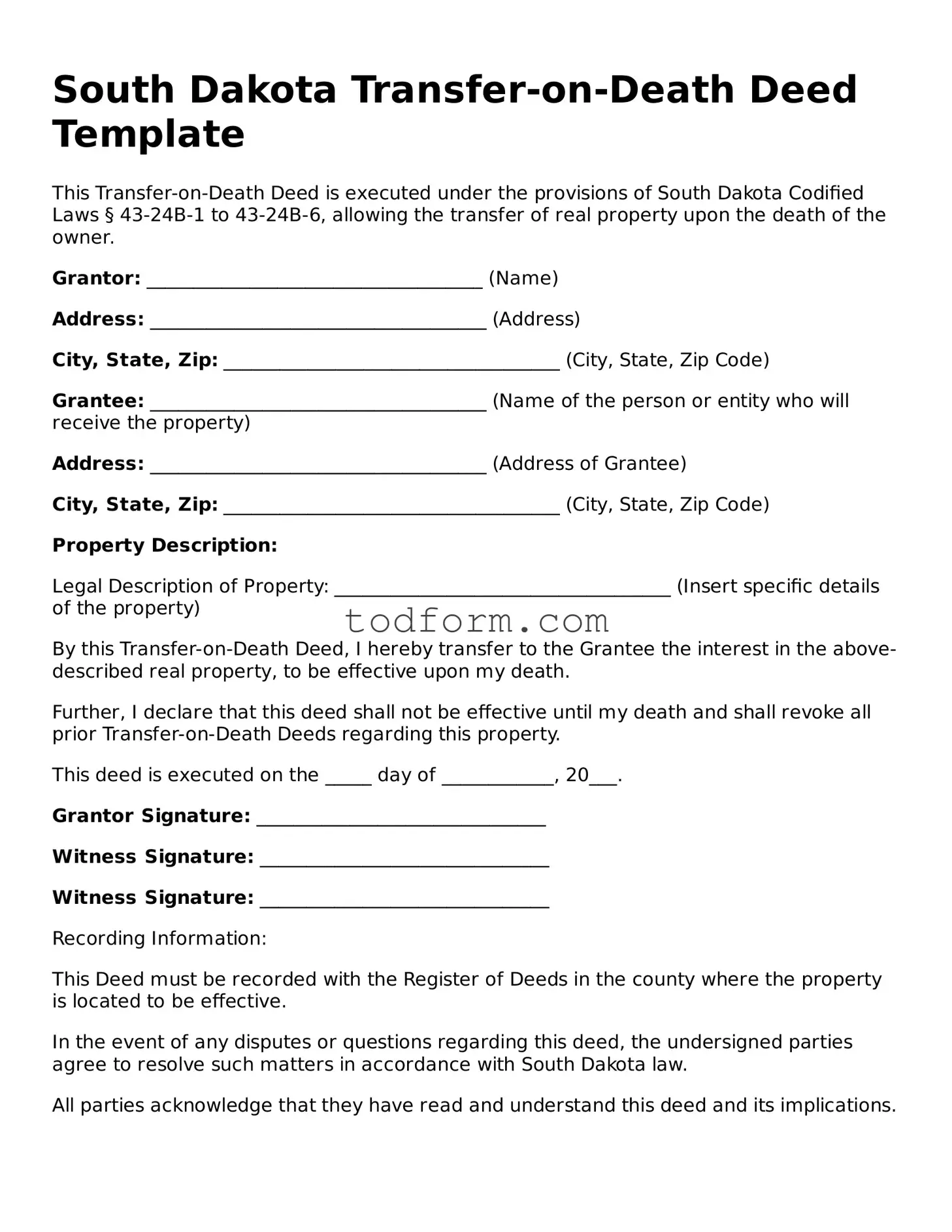

South Dakota Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed under the provisions of South Dakota Codified Laws § 43-24B-1 to 43-24B-6, allowing the transfer of real property upon the death of the owner.

Grantor: ____________________________________ (Name)

Address: ____________________________________ (Address)

City, State, Zip: ____________________________________ (City, State, Zip Code)

Grantee: ____________________________________ (Name of the person or entity who will receive the property)

Address: ____________________________________ (Address of Grantee)

City, State, Zip: ____________________________________ (City, State, Zip Code)

Property Description:

Legal Description of Property: ____________________________________ (Insert specific details of the property)

By this Transfer-on-Death Deed, I hereby transfer to the Grantee the interest in the above-described real property, to be effective upon my death.

Further, I declare that this deed shall not be effective until my death and shall revoke all prior Transfer-on-Death Deeds regarding this property.

This deed is executed on the _____ day of ____________, 20___.

Grantor Signature: _______________________________

Witness Signature: _______________________________

Witness Signature: _______________________________

Recording Information:

This Deed must be recorded with the Register of Deeds in the county where the property is located to be effective.

In the event of any disputes or questions regarding this deed, the undersigned parties agree to resolve such matters in accordance with South Dakota law.

All parties acknowledge that they have read and understand this deed and its implications.