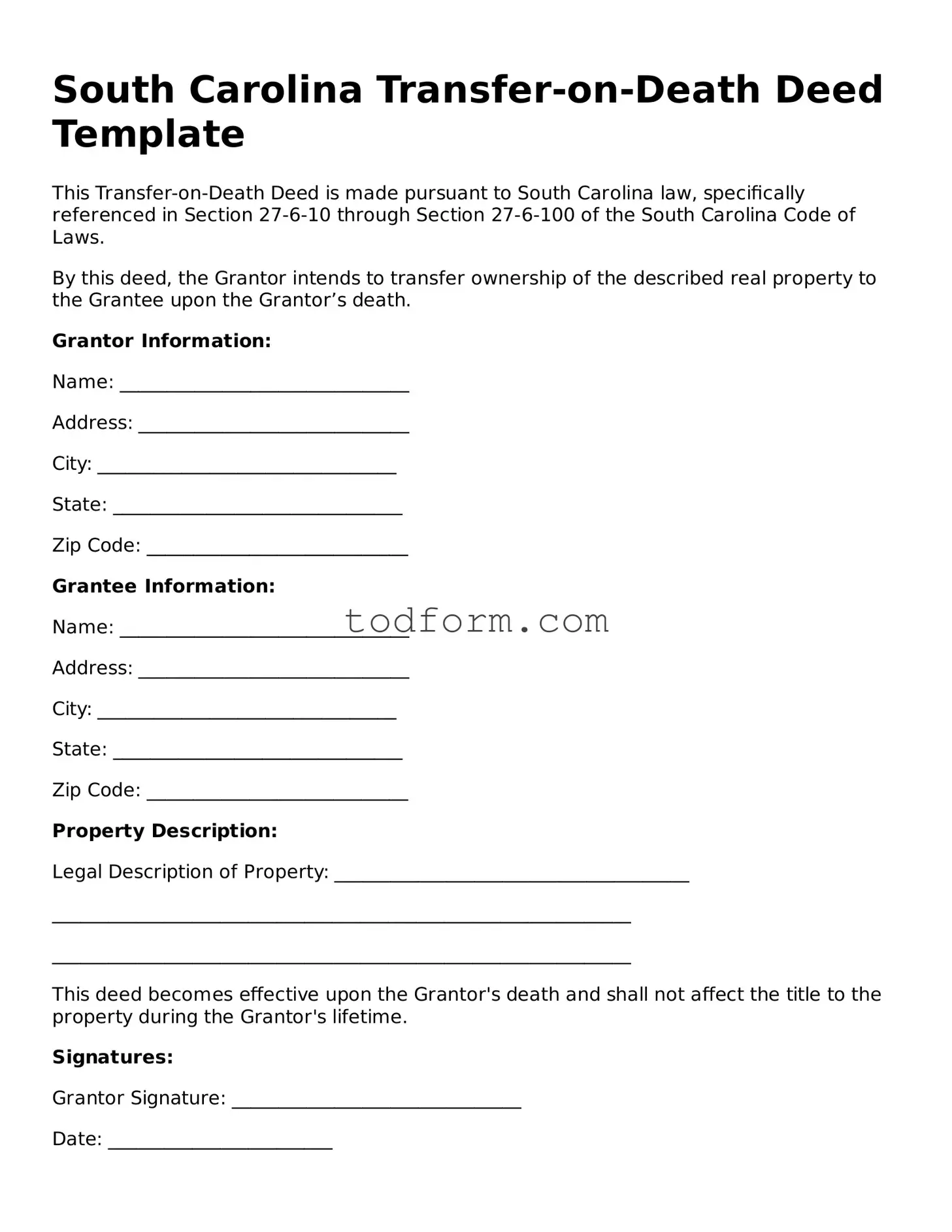

South Carolina Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to South Carolina law, specifically referenced in Section 27-6-10 through Section 27-6-100 of the South Carolina Code of Laws.

By this deed, the Grantor intends to transfer ownership of the described real property to the Grantee upon the Grantor’s death.

Grantor Information:

Name: _______________________________

Address: _____________________________

City: ________________________________

State: _______________________________

Zip Code: ____________________________

Grantee Information:

Name: _______________________________

Address: _____________________________

City: ________________________________

State: _______________________________

Zip Code: ____________________________

Property Description:

Legal Description of Property: ______________________________________

______________________________________________________________

______________________________________________________________

This deed becomes effective upon the Grantor's death and shall not affect the title to the property during the Grantor's lifetime.

Signatures:

Grantor Signature: _______________________________

Date: ________________________

Acknowledgment:

State of South Carolina, County of ____________________

Before me, a Notary Public, personally appeared the above-named Grantor, who proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to this instrument, and acknowledged that he/she executed the same for the purposes therein contained.

Given under my hand and seal this ______ day of ______________, 20__.

Notary Public Signature: _______________________________

My Commission Expires: _______________________________