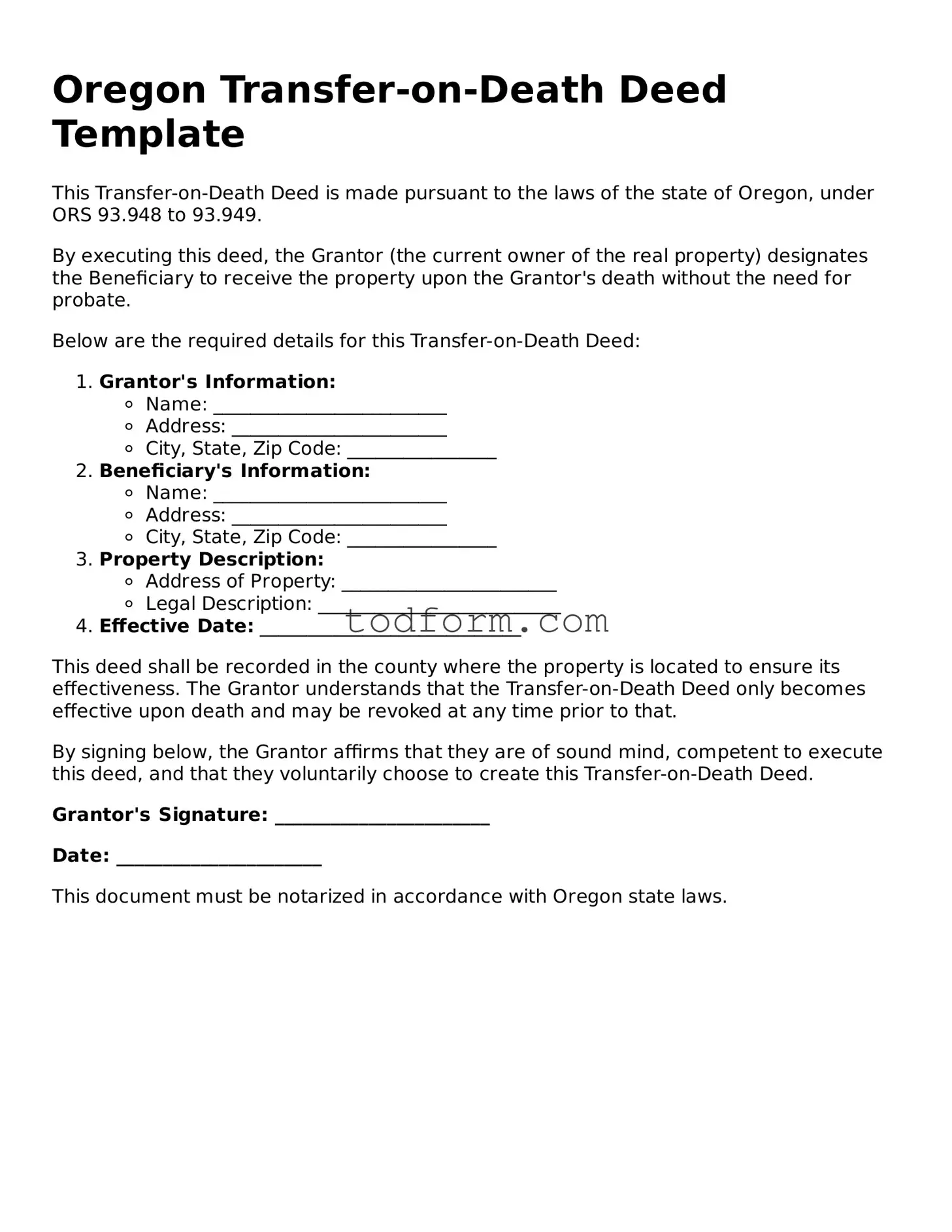

Oregon Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to the laws of the state of Oregon, under ORS 93.948 to 93.949.

By executing this deed, the Grantor (the current owner of the real property) designates the Beneficiary to receive the property upon the Grantor's death without the need for probate.

Below are the required details for this Transfer-on-Death Deed:

- Grantor's Information:

- Name: _________________________

- Address: _______________________

- City, State, Zip Code: ________________

- Beneficiary's Information:

- Name: _________________________

- Address: _______________________

- City, State, Zip Code: ________________

- Property Description:

- Address of Property: _______________________

- Legal Description: __________________________

- Effective Date: ____________________________

This deed shall be recorded in the county where the property is located to ensure its effectiveness. The Grantor understands that the Transfer-on-Death Deed only becomes effective upon death and may be revoked at any time prior to that.

By signing below, the Grantor affirms that they are of sound mind, competent to execute this deed, and that they voluntarily choose to create this Transfer-on-Death Deed.

Grantor's Signature: _______________________

Date: ______________________

This document must be notarized in accordance with Oregon state laws.