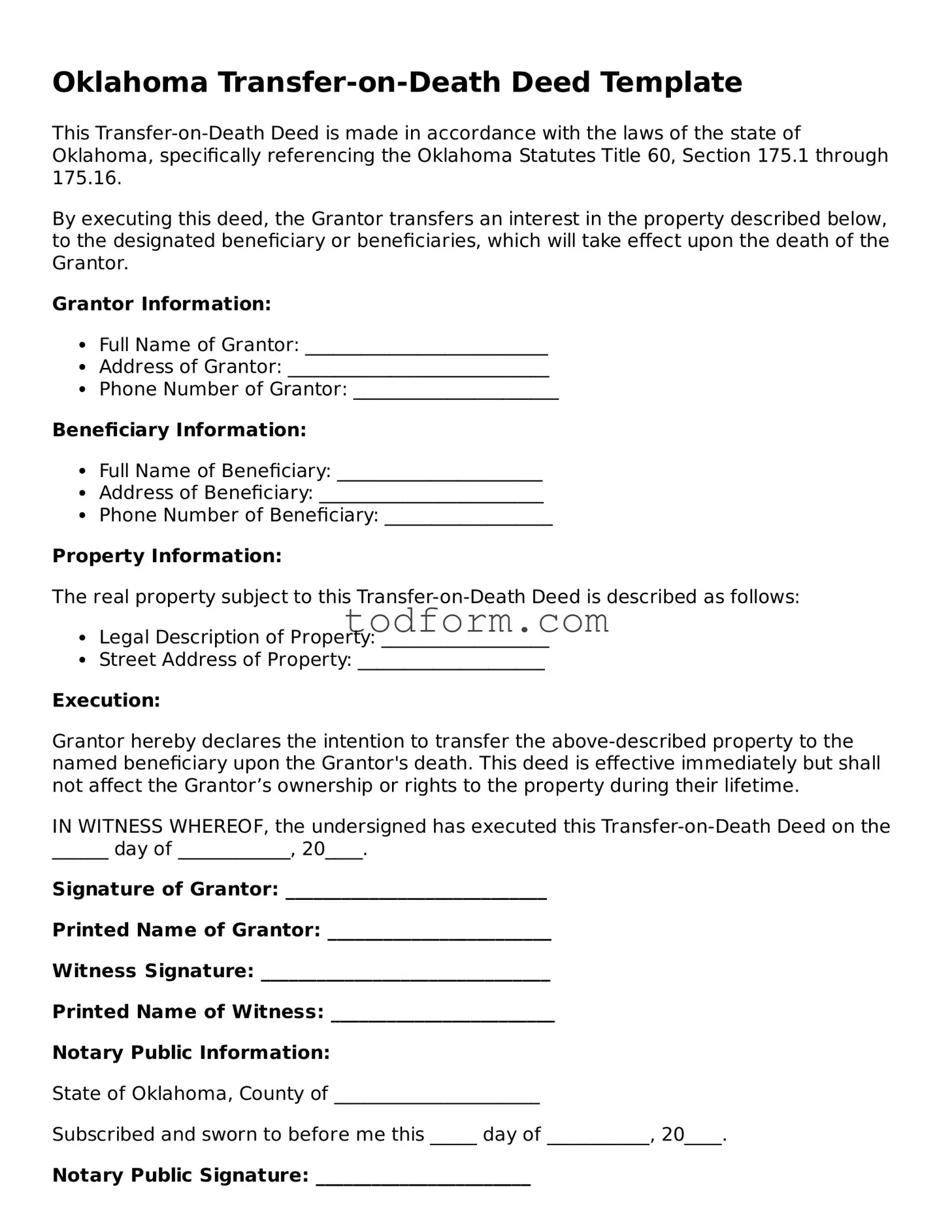

Oklahoma Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made in accordance with the laws of the state of Oklahoma, specifically referencing the Oklahoma Statutes Title 60, Section 175.1 through 175.16.

By executing this deed, the Grantor transfers an interest in the property described below, to the designated beneficiary or beneficiaries, which will take effect upon the death of the Grantor.

Grantor Information:

- Full Name of Grantor: __________________________

- Address of Grantor: ____________________________

- Phone Number of Grantor: ______________________

Beneficiary Information:

- Full Name of Beneficiary: ______________________

- Address of Beneficiary: ________________________

- Phone Number of Beneficiary: __________________

Property Information:

The real property subject to this Transfer-on-Death Deed is described as follows:

- Legal Description of Property: __________________

- Street Address of Property: ____________________

Execution:

Grantor hereby declares the intention to transfer the above-described property to the named beneficiary upon the Grantor's death. This deed is effective immediately but shall not affect the Grantor’s ownership or rights to the property during their lifetime.

IN WITNESS WHEREOF, the undersigned has executed this Transfer-on-Death Deed on the ______ day of ____________, 20____.

Signature of Grantor: ____________________________

Printed Name of Grantor: ________________________

Witness Signature: _______________________________

Printed Name of Witness: ________________________

Notary Public Information:

State of Oklahoma, County of ______________________

Subscribed and sworn to before me this _____ day of ___________, 20____.

Notary Public Signature: _______________________

My Commission Expires: ______________________