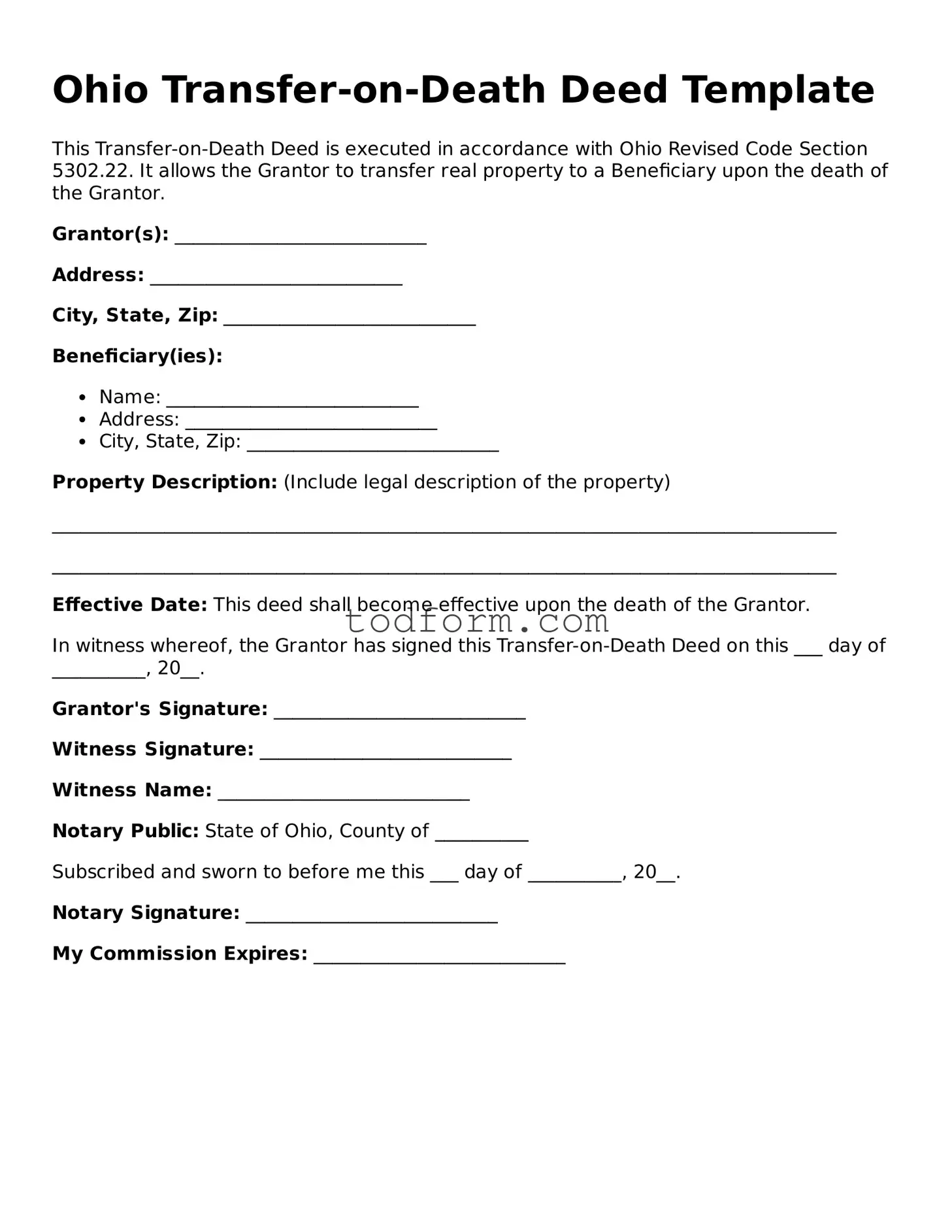

Ohio Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with Ohio Revised Code Section 5302.22. It allows the Grantor to transfer real property to a Beneficiary upon the death of the Grantor.

Grantor(s): ___________________________

Address: ___________________________

City, State, Zip: ___________________________

Beneficiary(ies):

- Name: ___________________________

- Address: ___________________________

- City, State, Zip: ___________________________

Property Description: (Include legal description of the property)

____________________________________________________________________________________

____________________________________________________________________________________

Effective Date: This deed shall become effective upon the death of the Grantor.

In witness whereof, the Grantor has signed this Transfer-on-Death Deed on this ___ day of __________, 20__.

Grantor's Signature: ___________________________

Witness Signature: ___________________________

Witness Name: ___________________________

Notary Public: State of Ohio, County of __________

Subscribed and sworn to before me this ___ day of __________, 20__.

Notary Signature: ___________________________

My Commission Expires: ___________________________