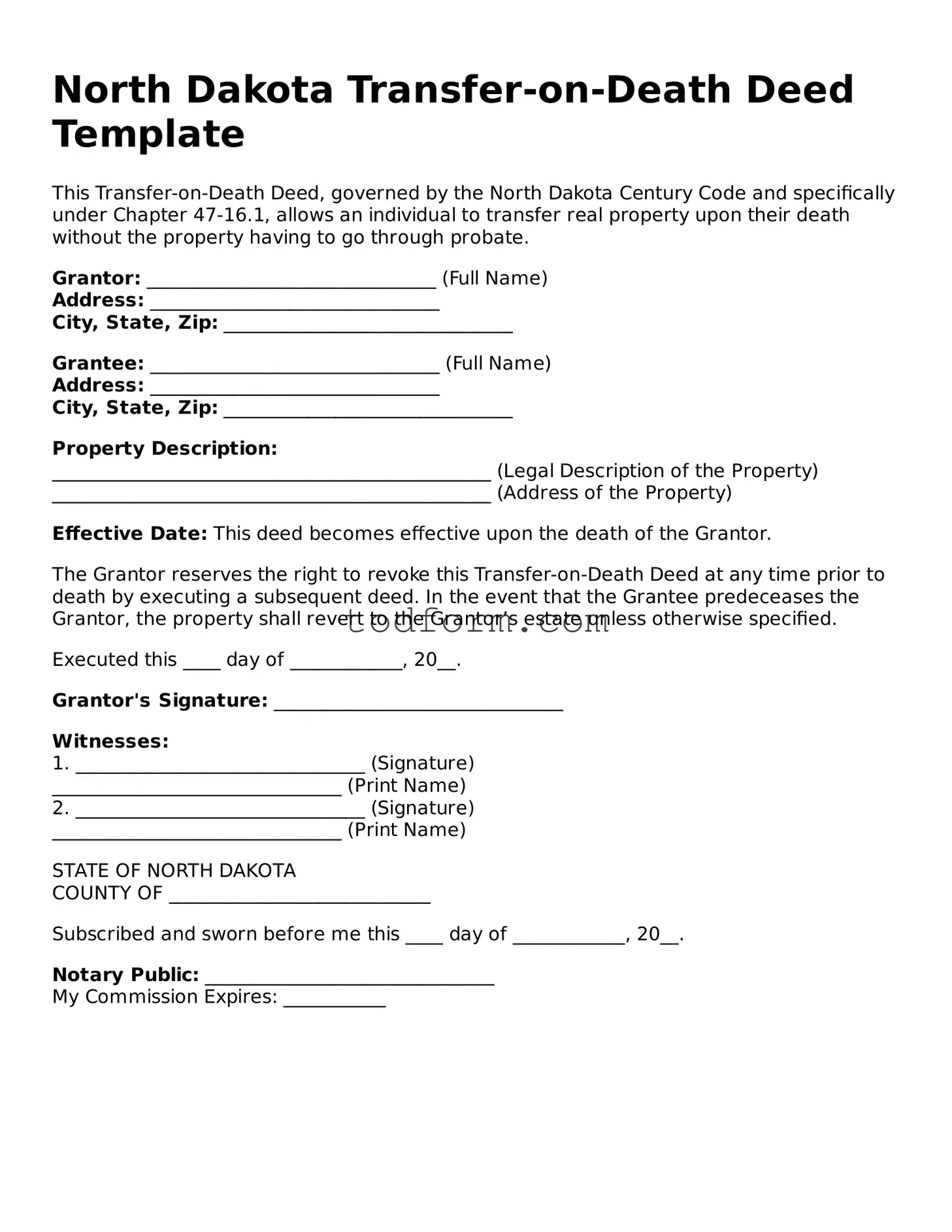

North Dakota Transfer-on-Death Deed Template

This Transfer-on-Death Deed, governed by the North Dakota Century Code and specifically under Chapter 47-16.1, allows an individual to transfer real property upon their death without the property having to go through probate.

Grantor: _______________________________ (Full Name)

Address: _______________________________

City, State, Zip: _______________________________

Grantee: _______________________________ (Full Name)

Address: _______________________________

City, State, Zip: _______________________________

Property Description:

_______________________________________________ (Legal Description of the Property)

_______________________________________________ (Address of the Property)

Effective Date: This deed becomes effective upon the death of the Grantor.

The Grantor reserves the right to revoke this Transfer-on-Death Deed at any time prior to death by executing a subsequent deed. In the event that the Grantee predeceases the Grantor, the property shall revert to the Grantor’s estate unless otherwise specified.

Executed this ____ day of ____________, 20__.

Grantor's Signature: _______________________________

Witnesses:

1. _______________________________ (Signature)

_______________________________ (Print Name)

2. _______________________________ (Signature)

_______________________________ (Print Name)

STATE OF NORTH DAKOTA

COUNTY OF ____________________________

Subscribed and sworn before me this ____ day of ____________, 20__.

Notary Public: _______________________________

My Commission Expires: ___________