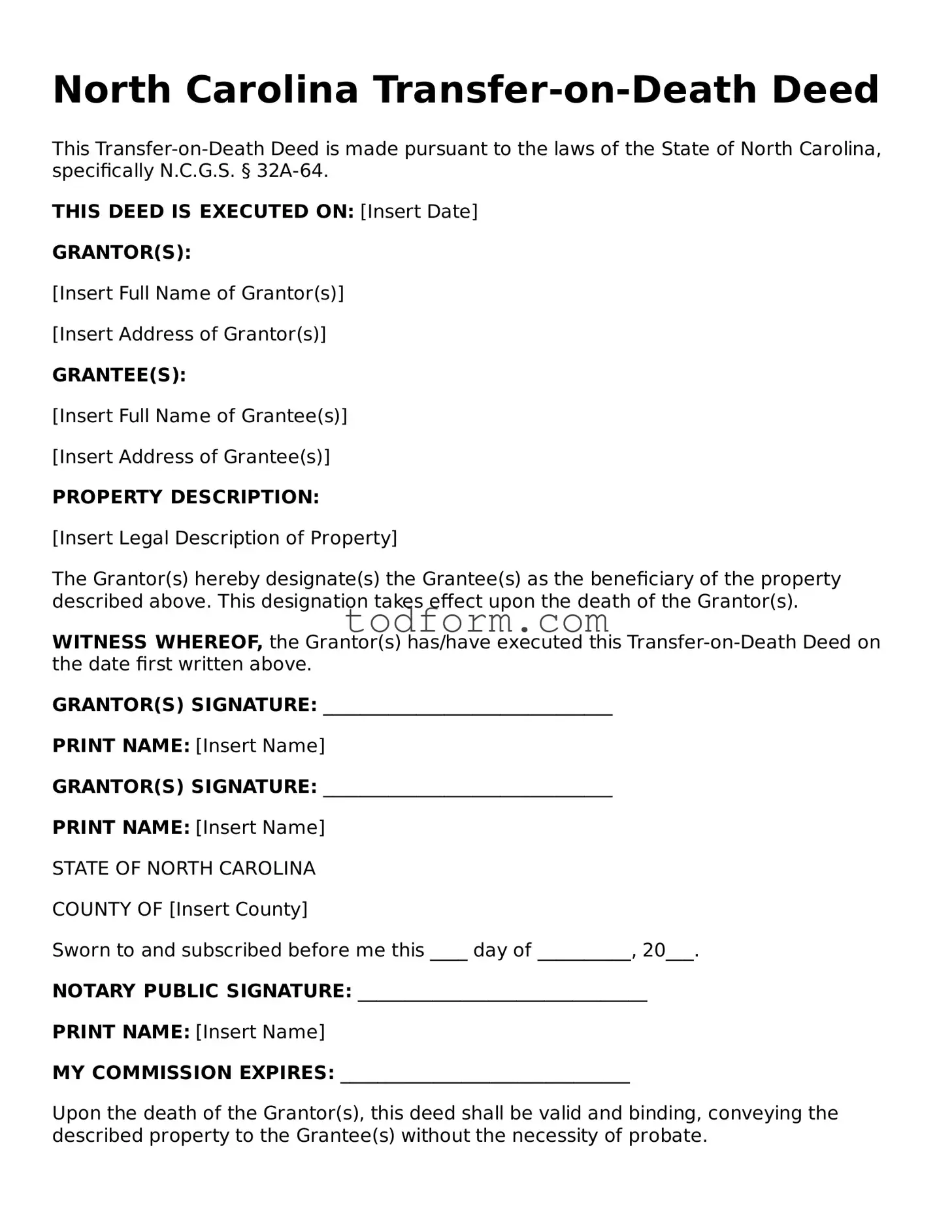

North Carolina Transfer-on-Death Deed

This Transfer-on-Death Deed is made pursuant to the laws of the State of North Carolina, specifically N.C.G.S. § 32A-64.

THIS DEED IS EXECUTED ON: [Insert Date]

GRANTOR(S):

[Insert Full Name of Grantor(s)]

[Insert Address of Grantor(s)]

GRANTEE(S):

[Insert Full Name of Grantee(s)]

[Insert Address of Grantee(s)]

PROPERTY DESCRIPTION:

[Insert Legal Description of Property]

The Grantor(s) hereby designate(s) the Grantee(s) as the beneficiary of the property described above. This designation takes effect upon the death of the Grantor(s).

WITNESS WHEREOF, the Grantor(s) has/have executed this Transfer-on-Death Deed on the date first written above.

GRANTOR(S) SIGNATURE: _______________________________

PRINT NAME: [Insert Name]

GRANTOR(S) SIGNATURE: _______________________________

PRINT NAME: [Insert Name]

STATE OF NORTH CAROLINA

COUNTY OF [Insert County]

Sworn to and subscribed before me this ____ day of __________, 20___.

NOTARY PUBLIC SIGNATURE: _______________________________

PRINT NAME: [Insert Name]

MY COMMISSION EXPIRES: _______________________________

Upon the death of the Grantor(s), this deed shall be valid and binding, conveying the described property to the Grantee(s) without the necessity of probate.