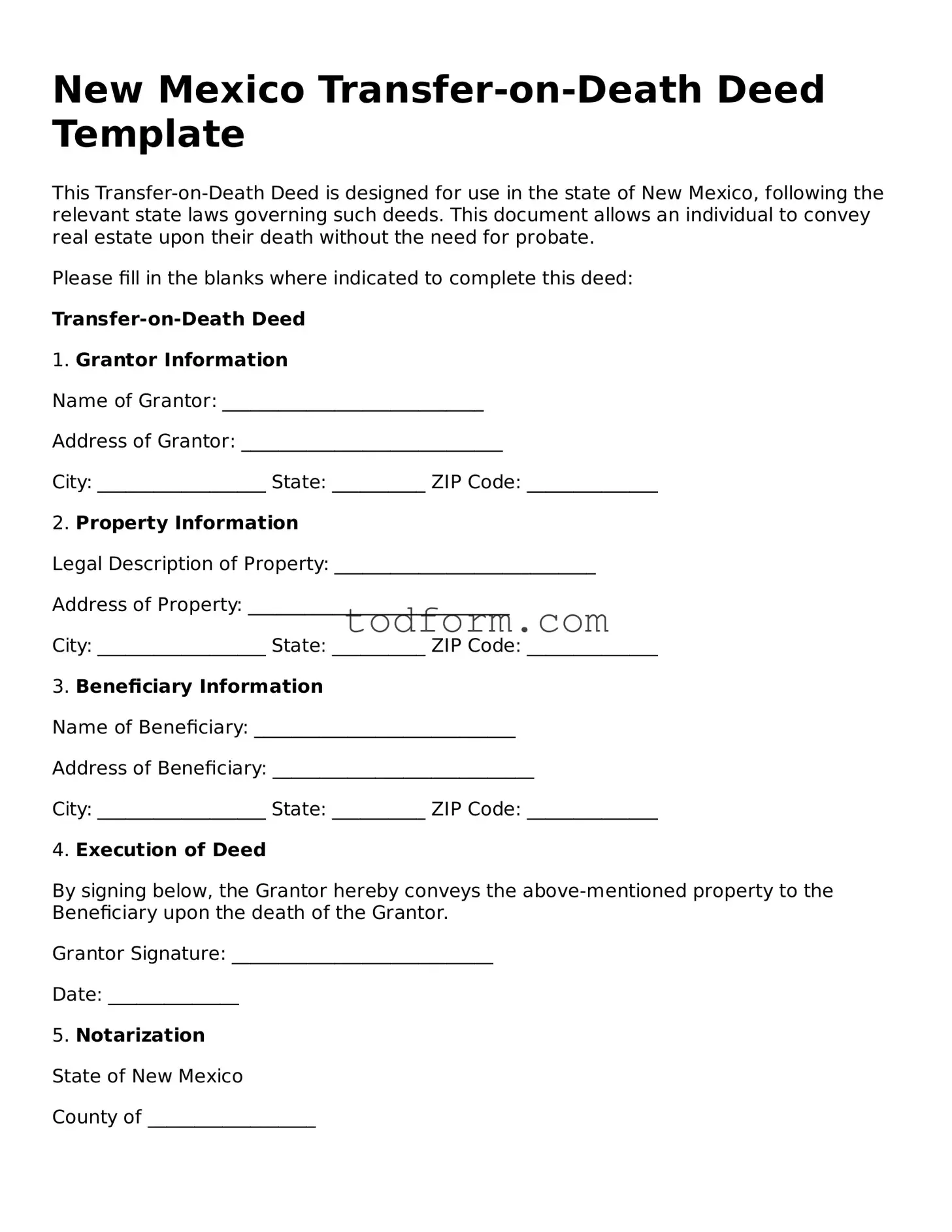

New Mexico Transfer-on-Death Deed Template

This Transfer-on-Death Deed is designed for use in the state of New Mexico, following the relevant state laws governing such deeds. This document allows an individual to convey real estate upon their death without the need for probate.

Please fill in the blanks where indicated to complete this deed:

Transfer-on-Death Deed

1. Grantor Information

Name of Grantor: ____________________________

Address of Grantor: ____________________________

City: __________________ State: __________ ZIP Code: ______________

2. Property Information

Legal Description of Property: ____________________________

Address of Property: ____________________________

City: __________________ State: __________ ZIP Code: ______________

3. Beneficiary Information

Name of Beneficiary: ____________________________

Address of Beneficiary: ____________________________

City: __________________ State: __________ ZIP Code: ______________

4. Execution of Deed

By signing below, the Grantor hereby conveys the above-mentioned property to the Beneficiary upon the death of the Grantor.

Grantor Signature: ____________________________

Date: ______________

5. Notarization

State of New Mexico

County of __________________

On this ______ day of ______________, 20___, before me, a Notary Public, personally appeared ____________________________ (Grantor's Name) known to me (or satisfactorily proven) to be the person whose name is subscribed to this instrument, and acknowledged that he/she executed the same for the purposes therein contained.

Witness my hand and official seal.

Notary Public Signature: ____________________________

My Commission Expires: ____________________________

This document should be recorded with the County Clerk's office in the county where the property is located for it to be effective. Always consider seeking a qualified attorney before creating legal documents.