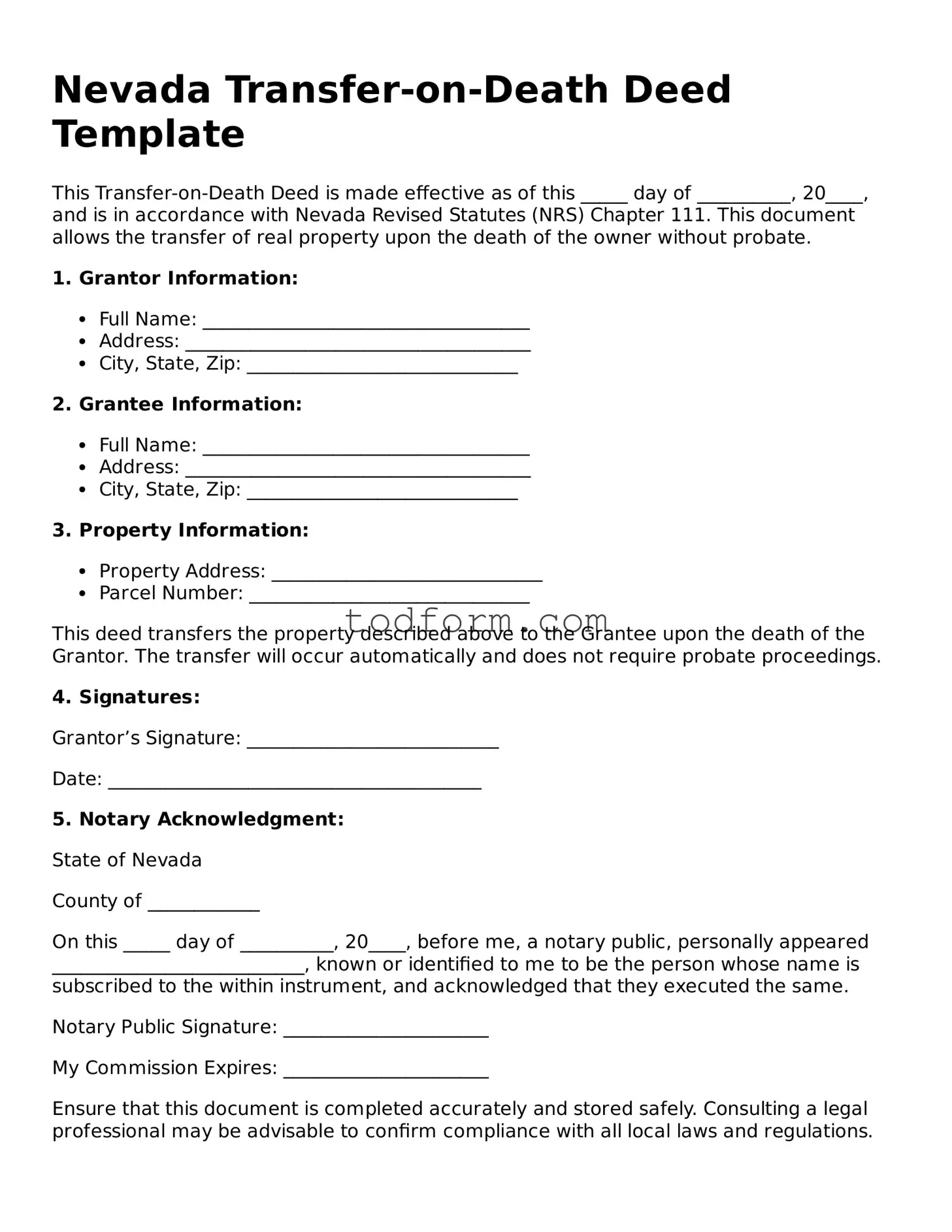

Nevada Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made effective as of this _____ day of __________, 20____, and is in accordance with Nevada Revised Statutes (NRS) Chapter 111. This document allows the transfer of real property upon the death of the owner without probate.

1. Grantor Information:

- Full Name: ___________________________________

- Address: _____________________________________

- City, State, Zip: _____________________________

2. Grantee Information:

- Full Name: ___________________________________

- Address: _____________________________________

- City, State, Zip: _____________________________

3. Property Information:

- Property Address: _____________________________

- Parcel Number: ______________________________

This deed transfers the property described above to the Grantee upon the death of the Grantor. The transfer will occur automatically and does not require probate proceedings.

4. Signatures:

Grantor’s Signature: ___________________________

Date: ________________________________________

5. Notary Acknowledgment:

State of Nevada

County of ____________

On this _____ day of __________, 20____, before me, a notary public, personally appeared ___________________________, known or identified to me to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same.

Notary Public Signature: ______________________

My Commission Expires: ______________________

Ensure that this document is completed accurately and stored safely. Consulting a legal professional may be advisable to confirm compliance with all local laws and regulations.