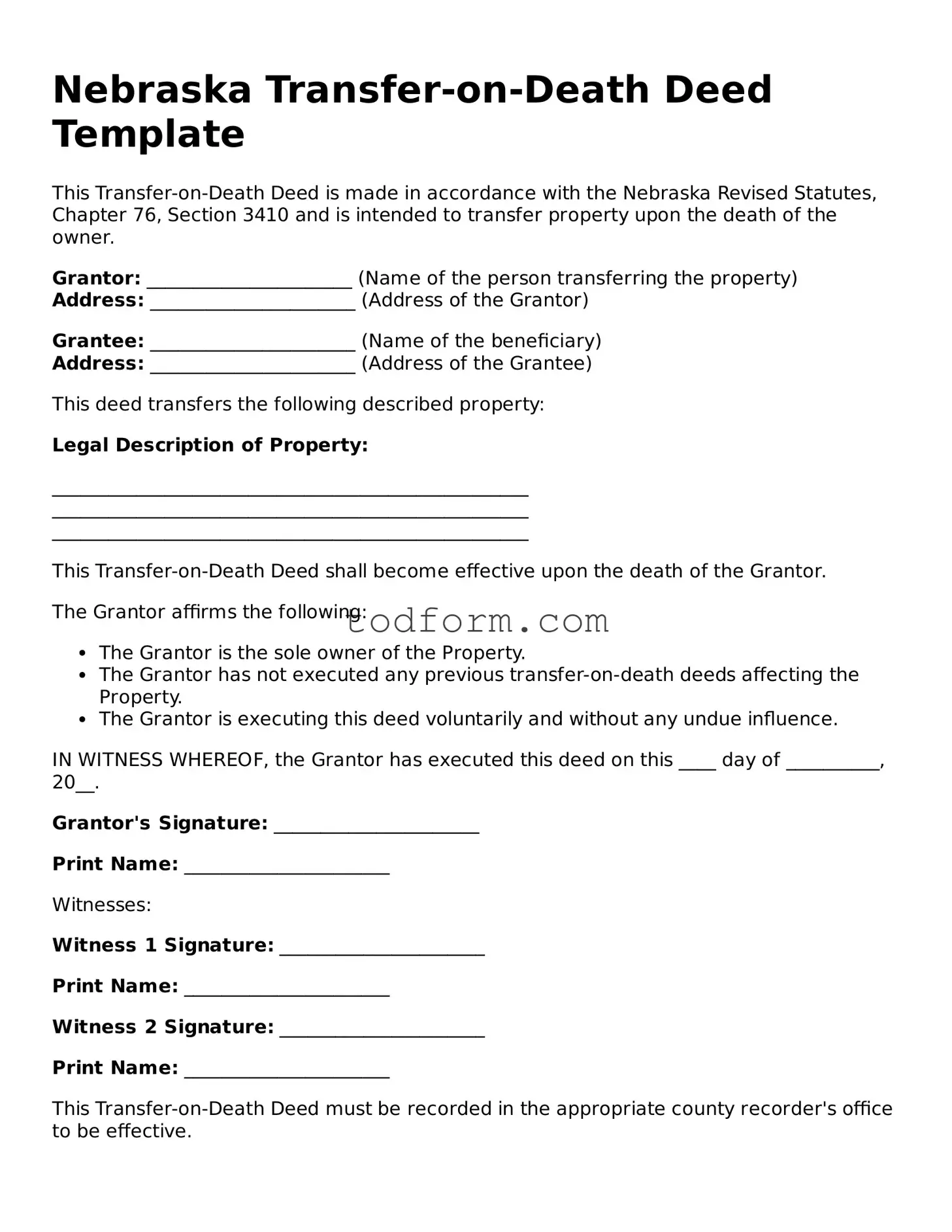

Nebraska Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made in accordance with the Nebraska Revised Statutes, Chapter 76, Section 3410 and is intended to transfer property upon the death of the owner.

Grantor: ______________________ (Name of the person transferring the property)

Address: ______________________ (Address of the Grantor)

Grantee: ______________________ (Name of the beneficiary)

Address: ______________________ (Address of the Grantee)

This deed transfers the following described property:

Legal Description of Property:

___________________________________________________

___________________________________________________

___________________________________________________

This Transfer-on-Death Deed shall become effective upon the death of the Grantor.

The Grantor affirms the following:

- The Grantor is the sole owner of the Property.

- The Grantor has not executed any previous transfer-on-death deeds affecting the Property.

- The Grantor is executing this deed voluntarily and without any undue influence.

IN WITNESS WHEREOF, the Grantor has executed this deed on this ____ day of __________, 20__.

Grantor's Signature: ______________________

Print Name: ______________________

Witnesses:

Witness 1 Signature: ______________________

Print Name: ______________________

Witness 2 Signature: ______________________

Print Name: ______________________

This Transfer-on-Death Deed must be recorded in the appropriate county recorder's office to be effective.