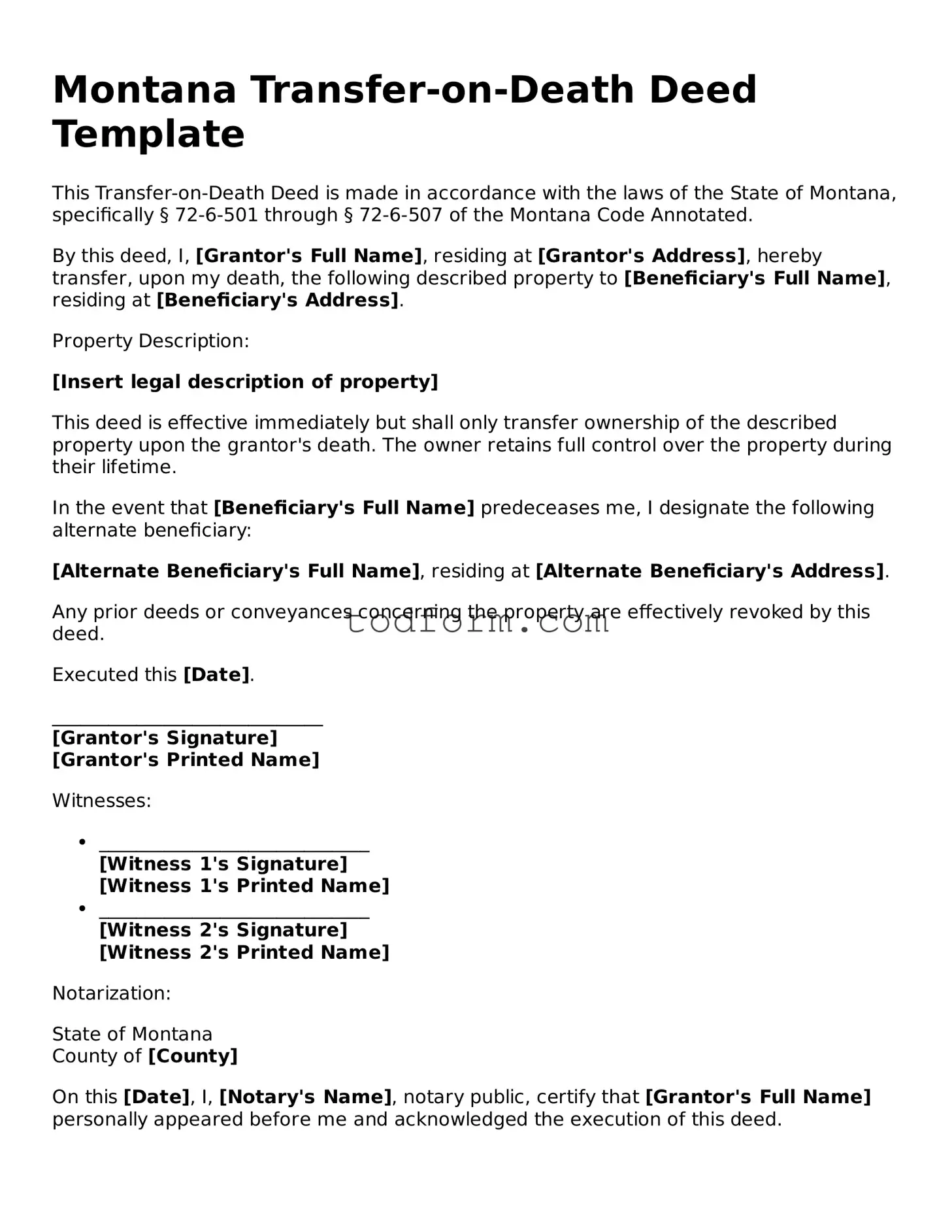

Montana Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made in accordance with the laws of the State of Montana, specifically § 72-6-501 through § 72-6-507 of the Montana Code Annotated.

By this deed, I, [Grantor's Full Name], residing at [Grantor's Address], hereby transfer, upon my death, the following described property to [Beneficiary's Full Name], residing at [Beneficiary's Address].

Property Description:

[Insert legal description of property]

This deed is effective immediately but shall only transfer ownership of the described property upon the grantor's death. The owner retains full control over the property during their lifetime.

In the event that [Beneficiary's Full Name] predeceases me, I designate the following alternate beneficiary:

[Alternate Beneficiary's Full Name], residing at [Alternate Beneficiary's Address].

Any prior deeds or conveyances concerning the property are effectively revoked by this deed.

Executed this [Date].

_____________________________

[Grantor's Signature]

[Grantor's Printed Name]

Witnesses:

- _____________________________

[Witness 1's Signature]

[Witness 1's Printed Name]

- _____________________________

[Witness 2's Signature]

[Witness 2's Printed Name]

Notarization:

State of Montana

County of [County]

On this [Date], I, [Notary's Name], notary public, certify that [Grantor's Full Name] personally appeared before me and acknowledged the execution of this deed.

_____________________________

[Notary's Signature]

[Notary's Printed Name]

My Commission Expires: [Expiration Date]