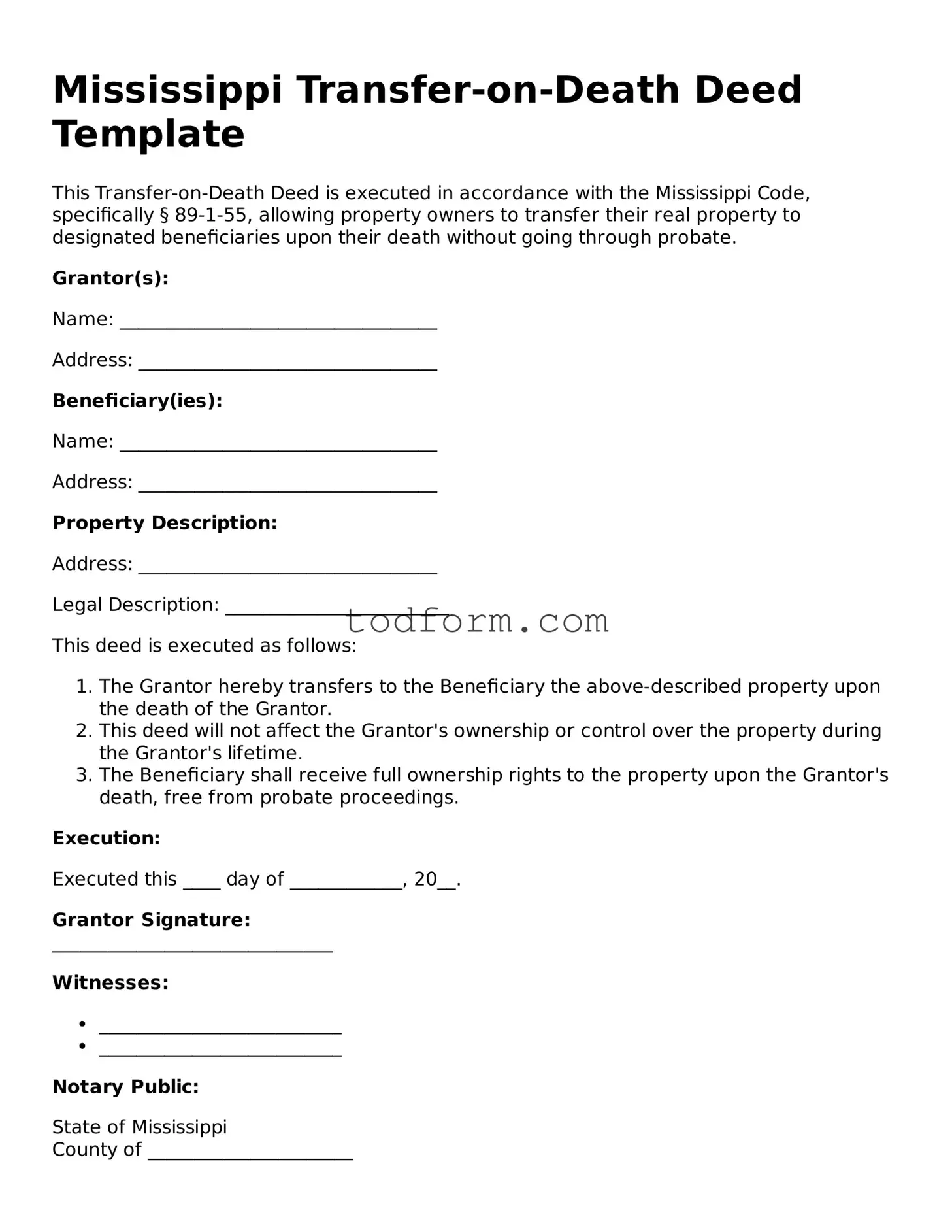

Mississippi Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the Mississippi Code, specifically § 89-1-55, allowing property owners to transfer their real property to designated beneficiaries upon their death without going through probate.

Grantor(s):

Name: __________________________________

Address: ________________________________

Beneficiary(ies):

Name: __________________________________

Address: ________________________________

Property Description:

Address: ________________________________

Legal Description: ________________________

This deed is executed as follows:

- The Grantor hereby transfers to the Beneficiary the above-described property upon the death of the Grantor.

- This deed will not affect the Grantor's ownership or control over the property during the Grantor's lifetime.

- The Beneficiary shall receive full ownership rights to the property upon the Grantor's death, free from probate proceedings.

Execution:

Executed this ____ day of ____________, 20__.

Grantor Signature:

______________________________

Witnesses:

- __________________________

- __________________________

Notary Public:

State of Mississippi

County of ______________________

Subscribed and sworn to before me on this ____ day of ____________, 20__.

______________________________

Notary Public

My commission expires: ____________