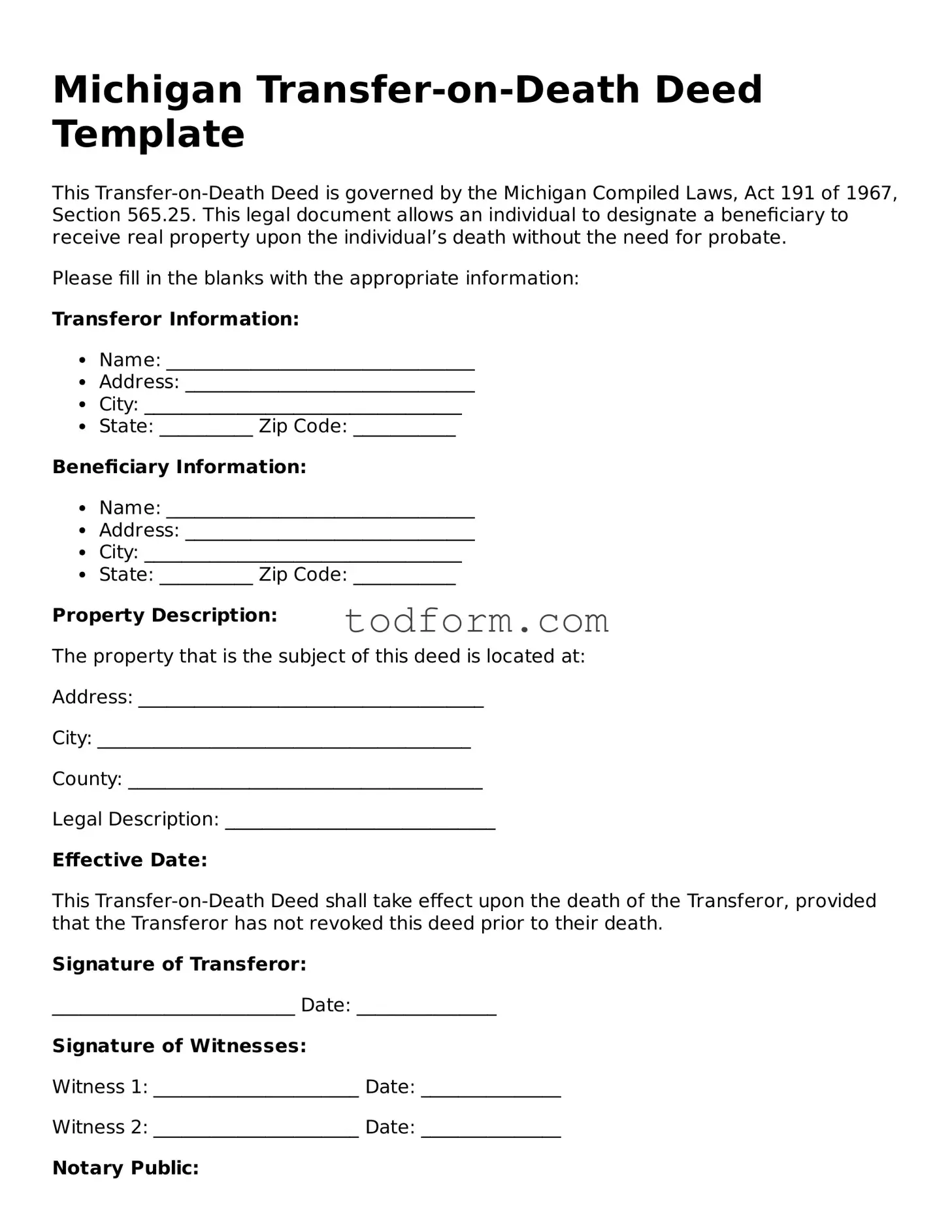

Michigan Transfer-on-Death Deed Template

This Transfer-on-Death Deed is governed by the Michigan Compiled Laws, Act 191 of 1967, Section 565.25. This legal document allows an individual to designate a beneficiary to receive real property upon the individual’s death without the need for probate.

Please fill in the blanks with the appropriate information:

Transferor Information:

- Name: _________________________________

- Address: _______________________________

- City: __________________________________

- State: __________ Zip Code: ___________

Beneficiary Information:

- Name: _________________________________

- Address: _______________________________

- City: __________________________________

- State: __________ Zip Code: ___________

Property Description:

The property that is the subject of this deed is located at:

Address: _____________________________________

City: ________________________________________

County: ______________________________________

Legal Description: _____________________________

Effective Date:

This Transfer-on-Death Deed shall take effect upon the death of the Transferor, provided that the Transferor has not revoked this deed prior to their death.

Signature of Transferor:

__________________________ Date: _______________

Signature of Witnesses:

Witness 1: ______________________ Date: _______________

Witness 2: ______________________ Date: _______________

Notary Public:

State of Michigan

County of ___________________________

Subscribed and sworn before me on this ___ day of ____________, 20__.

_______________________________

Notary Public

My Commission Expires: ________________

This document should be recorded with the county register of deeds in accordance with Michigan law.