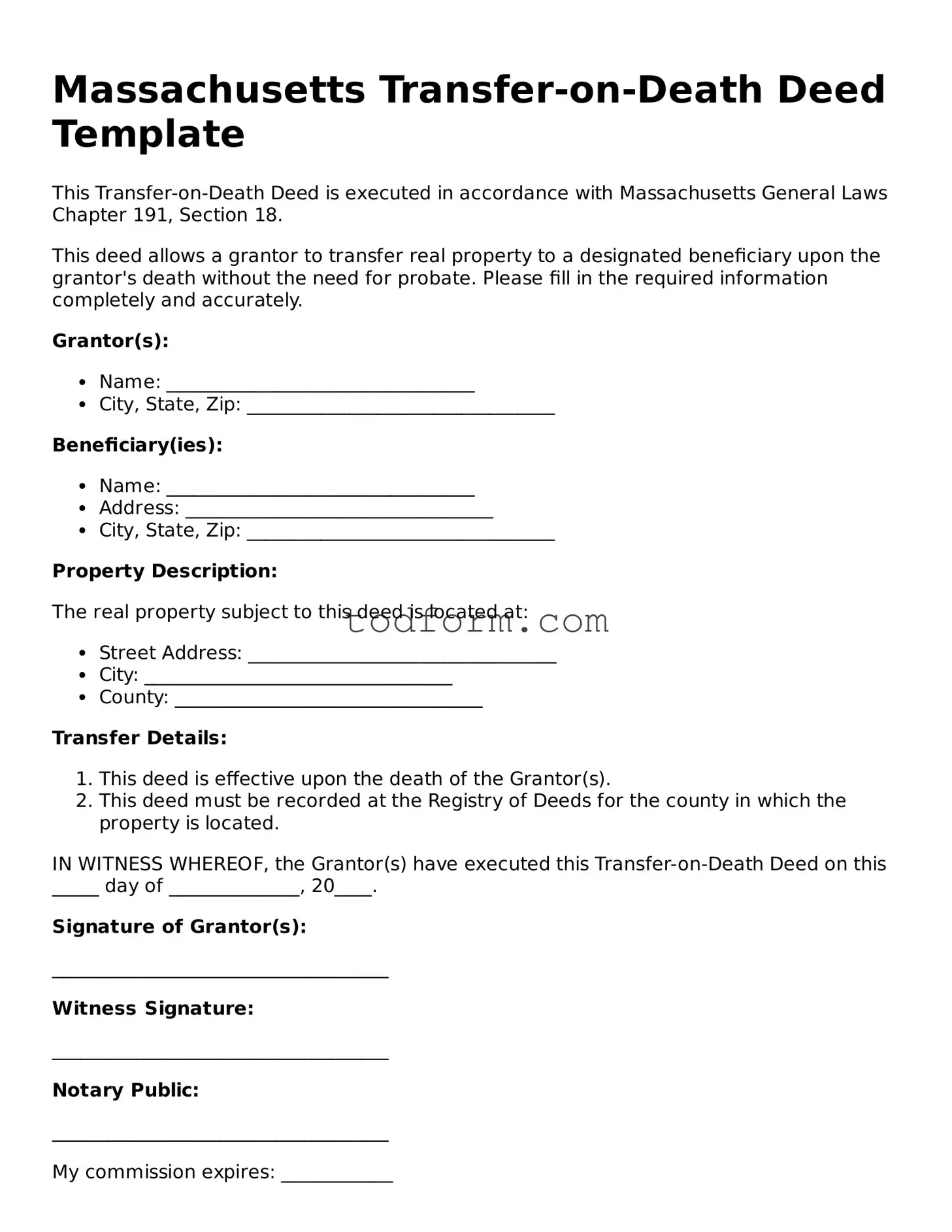

Massachusetts Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with Massachusetts General Laws Chapter 191, Section 18.

This deed allows a grantor to transfer real property to a designated beneficiary upon the grantor's death without the need for probate. Please fill in the required information completely and accurately.

Grantor(s):

- Name: _________________________________

- City, State, Zip: _________________________________

Beneficiary(ies):

- Name: _________________________________

- Address: _________________________________

- City, State, Zip: _________________________________

Property Description:

The real property subject to this deed is located at:

- Street Address: _________________________________

- City: _________________________________

- County: _________________________________

Transfer Details:

- This deed is effective upon the death of the Grantor(s).

- This deed must be recorded at the Registry of Deeds for the county in which the property is located.

IN WITNESS WHEREOF, the Grantor(s) have executed this Transfer-on-Death Deed on this _____ day of ______________, 20____.

Signature of Grantor(s):

____________________________________

Witness Signature:

____________________________________

Notary Public:

____________________________________

My commission expires: ____________