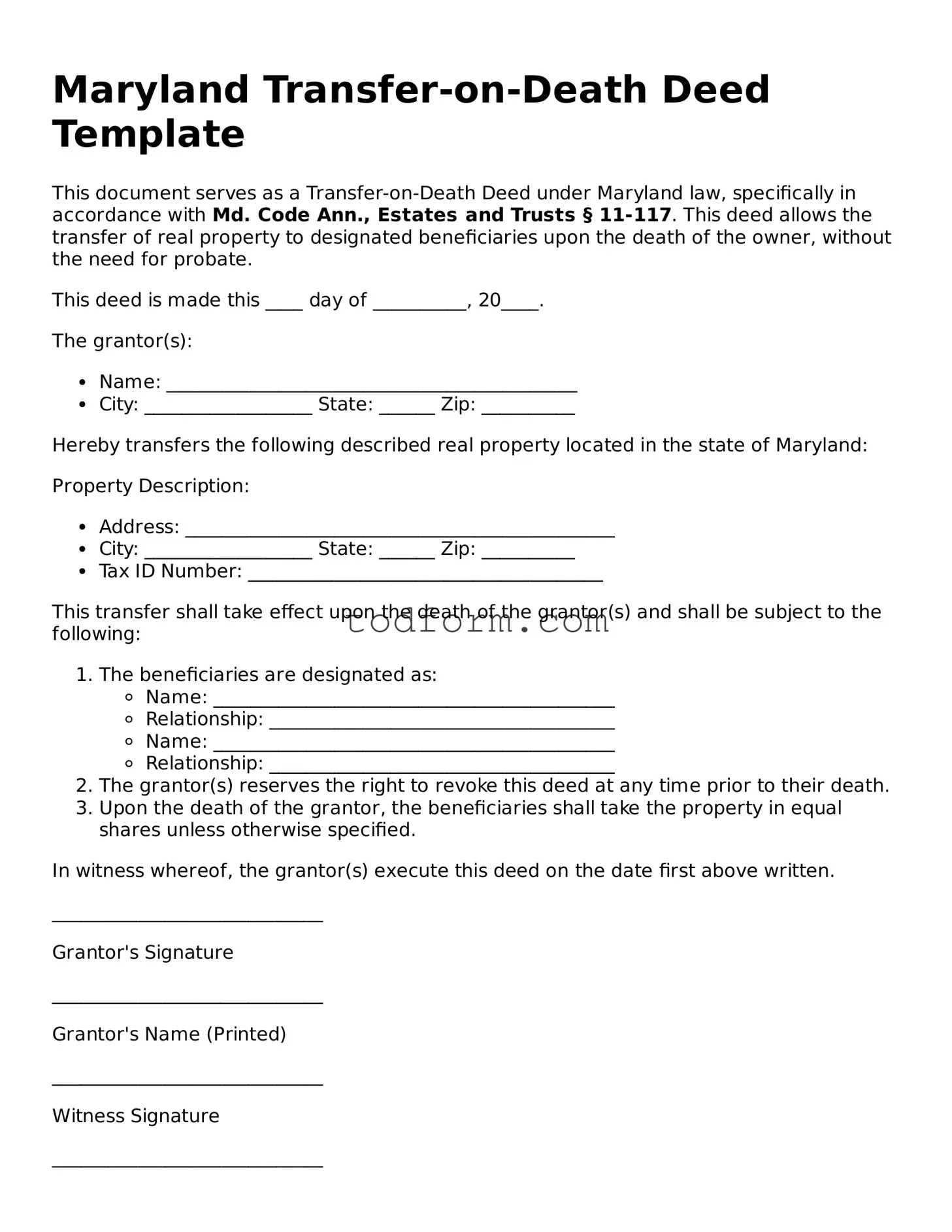

Maryland Transfer-on-Death Deed Template

This document serves as a Transfer-on-Death Deed under Maryland law, specifically in accordance with Md. Code Ann., Estates and Trusts § 11-117. This deed allows the transfer of real property to designated beneficiaries upon the death of the owner, without the need for probate.

This deed is made this ____ day of __________, 20____.

The grantor(s):

- Name: ____________________________________________

- City: __________________ State: ______ Zip: __________

Hereby transfers the following described real property located in the state of Maryland:

Property Description:

- Address: ______________________________________________

- City: __________________ State: ______ Zip: __________

- Tax ID Number: ______________________________________

This transfer shall take effect upon the death of the grantor(s) and shall be subject to the following:

- The beneficiaries are designated as:

- Name: ___________________________________________

- Relationship: _____________________________________

- Name: ___________________________________________

- Relationship: _____________________________________

- The grantor(s) reserves the right to revoke this deed at any time prior to their death.

- Upon the death of the grantor, the beneficiaries shall take the property in equal shares unless otherwise specified.

In witness whereof, the grantor(s) execute this deed on the date first above written.

_____________________________

Grantor's Signature

_____________________________

Grantor's Name (Printed)

_____________________________

Witness Signature

_____________________________

Witness Name (Printed)

_____________________________

Notary Public Signature

My commission expires: ________________________