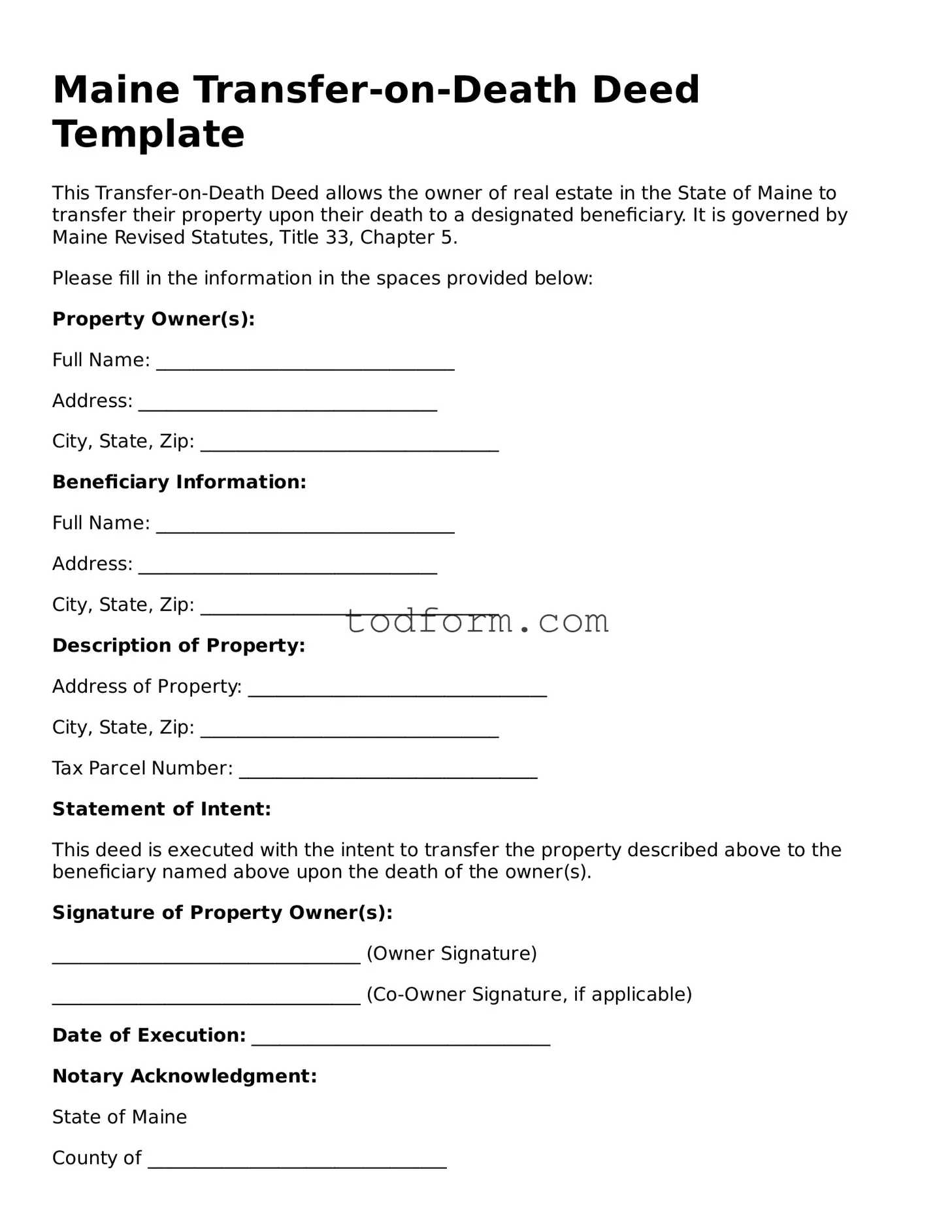

Maine Transfer-on-Death Deed Template

This Transfer-on-Death Deed allows the owner of real estate in the State of Maine to transfer their property upon their death to a designated beneficiary. It is governed by Maine Revised Statutes, Title 33, Chapter 5.

Please fill in the information in the spaces provided below:

Property Owner(s):

Full Name: ________________________________

Address: ________________________________

City, State, Zip: ________________________________

Beneficiary Information:

Full Name: ________________________________

Address: ________________________________

City, State, Zip: ________________________________

Description of Property:

Address of Property: ________________________________

City, State, Zip: ________________________________

Tax Parcel Number: ________________________________

Statement of Intent:

This deed is executed with the intent to transfer the property described above to the beneficiary named above upon the death of the owner(s).

Signature of Property Owner(s):

_________________________________ (Owner Signature)

_________________________________ (Co-Owner Signature, if applicable)

Date of Execution: ________________________________

Notary Acknowledgment:

State of Maine

County of ________________________________

On this ____ day of ________________, 20____, before me, a notary public, personally appeared ________________________________ (Property Owner's name), known to me (or satisfactorily proven) to be the person whose name is subscribed to the within document, and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

_________________________________ (Notary Public)

My commission expires: _______________