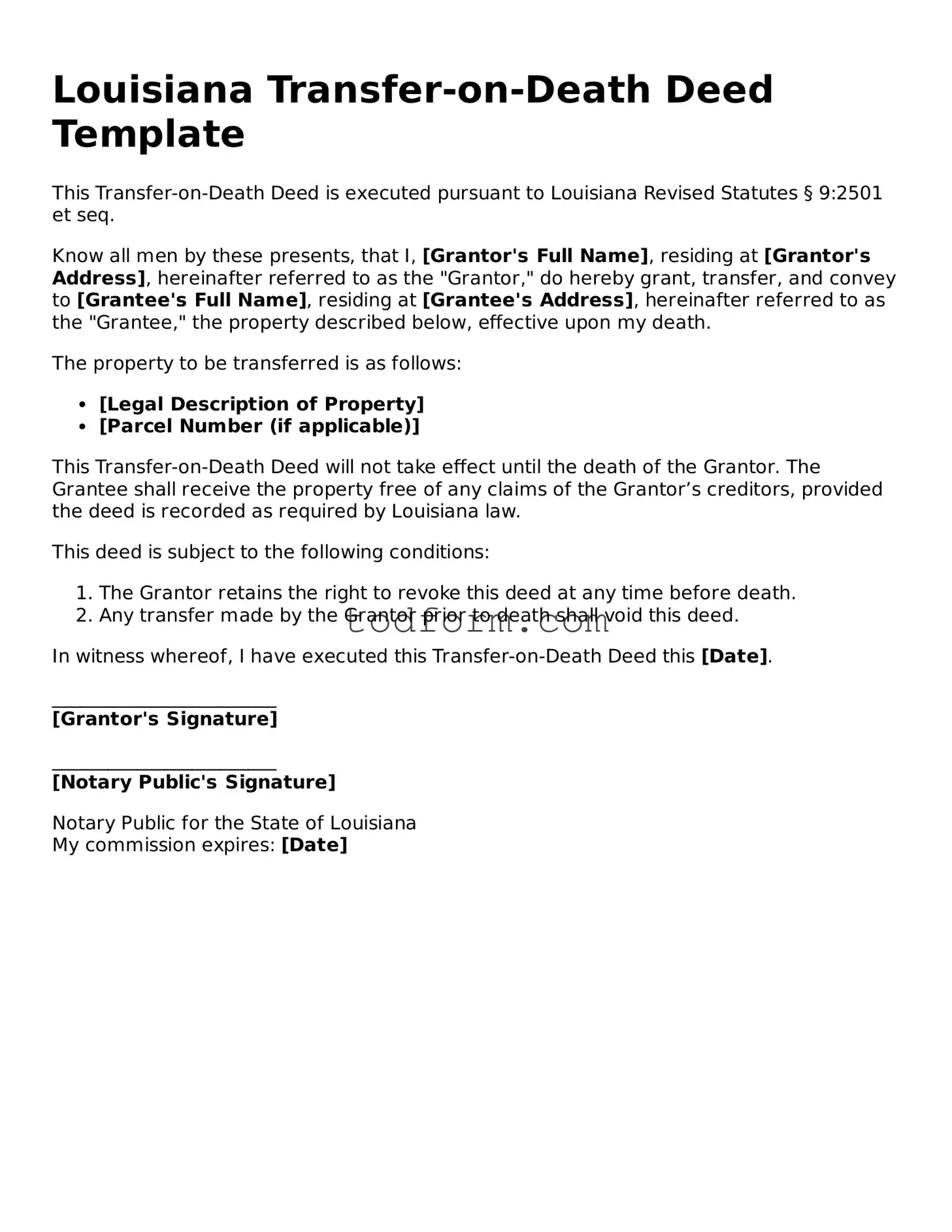

Louisiana Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed pursuant to Louisiana Revised Statutes § 9:2501 et seq.

Know all men by these presents, that I, [Grantor's Full Name], residing at [Grantor's Address], hereinafter referred to as the "Grantor," do hereby grant, transfer, and convey to [Grantee's Full Name], residing at [Grantee's Address], hereinafter referred to as the "Grantee," the property described below, effective upon my death.

The property to be transferred is as follows:

- [Legal Description of Property]

- [Parcel Number (if applicable)]

This Transfer-on-Death Deed will not take effect until the death of the Grantor. The Grantee shall receive the property free of any claims of the Grantor’s creditors, provided the deed is recorded as required by Louisiana law.

This deed is subject to the following conditions:

- The Grantor retains the right to revoke this deed at any time before death.

- Any transfer made by the Grantor prior to death shall void this deed.

In witness whereof, I have executed this Transfer-on-Death Deed this [Date].

________________________

[Grantor's Signature]

________________________

[Notary Public's Signature]

Notary Public for the State of Louisiana

My commission expires: [Date]