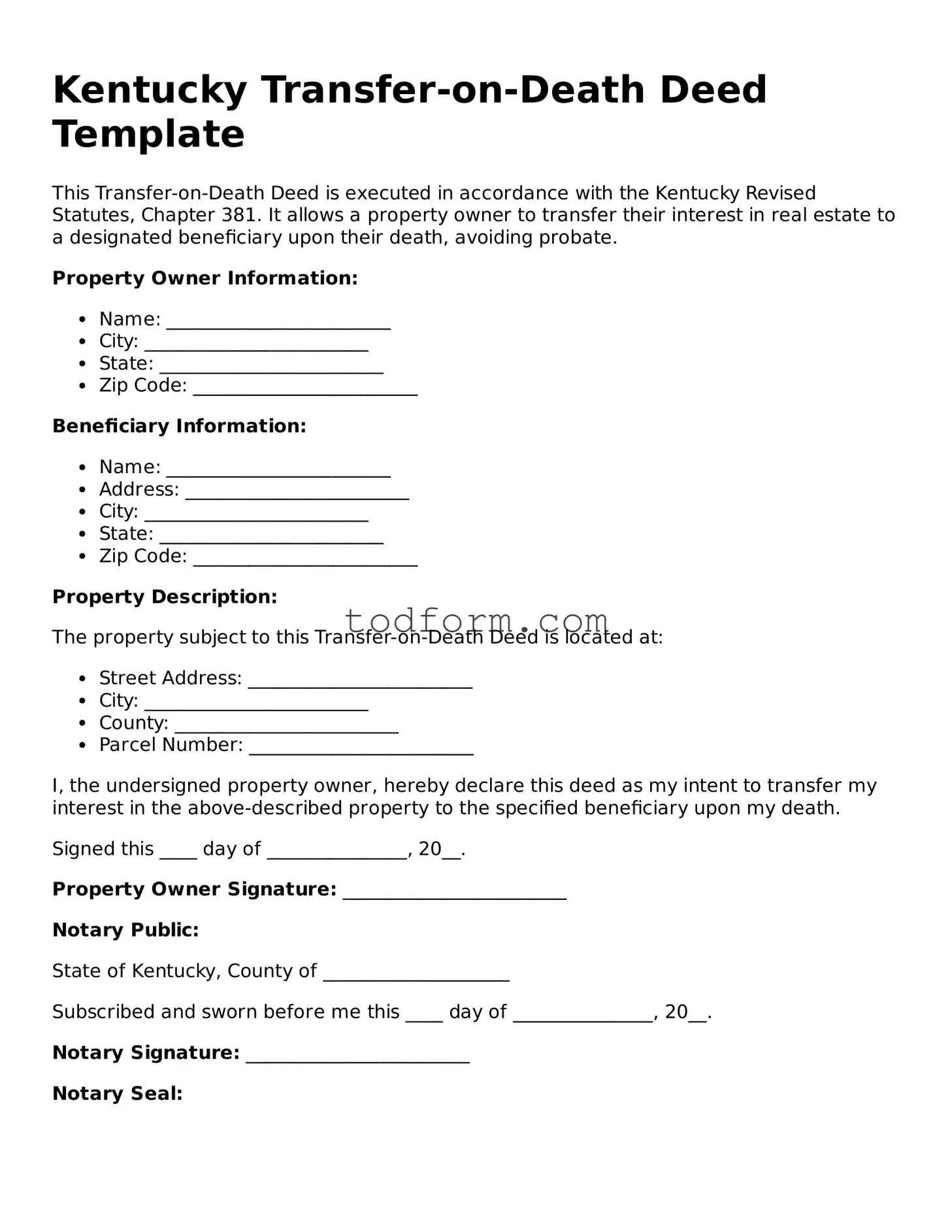

The Kentucky Transfer-on-Death Deed (TODD) is a unique legal instrument that allows property owners to transfer their real estate to beneficiaries upon their death without going through probate. It shares similarities with several other legal documents designed for the transfer of assets, each with its own specific function and benefits.

One such document is the Last Will and Testament. A will outlines how a person wishes to distribute their assets after they pass away. Like the TODD, a will allows for the transfer of property, but it must go through the probate process, which can be time-consuming and costly. In contrast, a TODD enables a more straightforward transfer directly to the designated beneficiaries without the need for probate, simplifying the process significantly.

Another similar document is the Living Trust. A living trust allows individuals to place their assets into a trust during their lifetime, which can then be managed by a trustee. Upon the individual’s death, the assets are distributed according to the terms of the trust. While both a living trust and a TODD avoid probate, a living trust can be more complex and may require ongoing management, whereas a TODD is typically simpler and only activates upon the owner’s death.

The Beneficiary Designation form is also comparable to the TODD. This document allows individuals to designate beneficiaries for certain assets, such as bank accounts or retirement plans, ensuring that these assets pass directly to the named individuals upon death. Like the TODD, beneficiary designations bypass probate, providing a quick transfer of assets. However, the scope of a TODD is limited to real estate, while beneficiary designations can apply to various types of accounts and policies.

A Transfer-on-Death Account (TOD Account) is another document that bears similarity to the TODD. A TOD account allows the account holder to name beneficiaries who will receive the funds in the account upon their death. This arrangement avoids probate, similar to the TODD. However, while the TODD applies specifically to real estate, a TOD account is used for financial assets, highlighting the versatility of transfer-on-death arrangements across different asset types.

The Joint Tenancy with Right of Survivorship (JTWROS) is another legal structure that allows for the transfer of property. In a JTWROS arrangement, when one owner passes away, their share of the property automatically transfers to the surviving owner(s). This method avoids probate, much like the TODD. However, unlike the TODD, JTWROS requires that the property be owned jointly, which may not be suitable for all situations.

The Life Estate Deed is also akin to the TODD. A life estate deed allows a property owner to transfer ownership of their property while retaining the right to live in it for the duration of their life. Upon the owner’s death, the property automatically transfers to the designated beneficiaries. While both documents facilitate the transfer of property, a life estate deed involves a more complex arrangement regarding the rights of the current owner during their lifetime.

The Power of Attorney (POA) can be viewed as a similar tool, although it serves a different purpose. A POA allows one person to act on behalf of another in legal or financial matters. While it does not directly transfer property upon death, it can be used to manage assets during the owner’s lifetime. The TODD, on the other hand, specifically addresses the transfer of real estate after death, providing clarity and ease for beneficiaries.

Lastly, the Affidavit of Heirship is a document that can be used to establish the heirs of a deceased individual. This affidavit is often used when there is no will or other estate planning documents in place. While it can facilitate the transfer of property, it does not provide the same level of clarity and direct transfer that a TODD offers, which clearly outlines the intended beneficiaries and avoids the complexities of proving heirship.