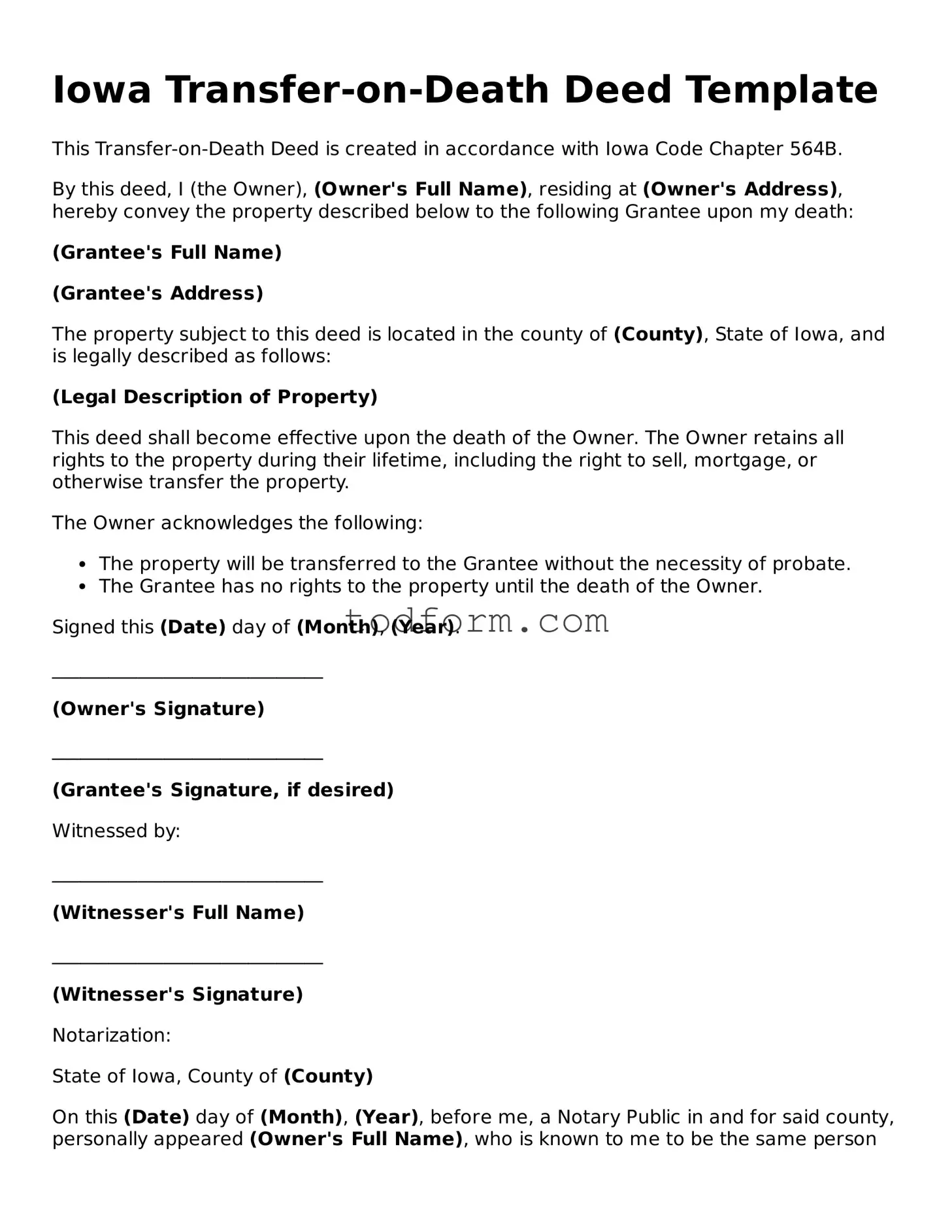

Iowa Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created in accordance with Iowa Code Chapter 564B.

By this deed, I (the Owner), (Owner's Full Name), residing at (Owner's Address), hereby convey the property described below to the following Grantee upon my death:

(Grantee's Full Name)

(Grantee's Address)

The property subject to this deed is located in the county of (County), State of Iowa, and is legally described as follows:

(Legal Description of Property)

This deed shall become effective upon the death of the Owner. The Owner retains all rights to the property during their lifetime, including the right to sell, mortgage, or otherwise transfer the property.

The Owner acknowledges the following:

- The property will be transferred to the Grantee without the necessity of probate.

- The Grantee has no rights to the property until the death of the Owner.

Signed this (Date) day of (Month), (Year).

_____________________________

(Owner's Signature)

_____________________________

(Grantee's Signature, if desired)

Witnessed by:

_____________________________

(Witnesser's Full Name)

_____________________________

(Witnesser's Signature)

Notarization:

State of Iowa, County of (County)

On this (Date) day of (Month), (Year), before me, a Notary Public in and for said county, personally appeared (Owner's Full Name), who is known to me to be the same person whose name is subscribed to this deed, and acknowledged that the execution of this deed was voluntary and of their own free will.

_____________________________

Notary Public Signature

My Commission Expires: _________________________