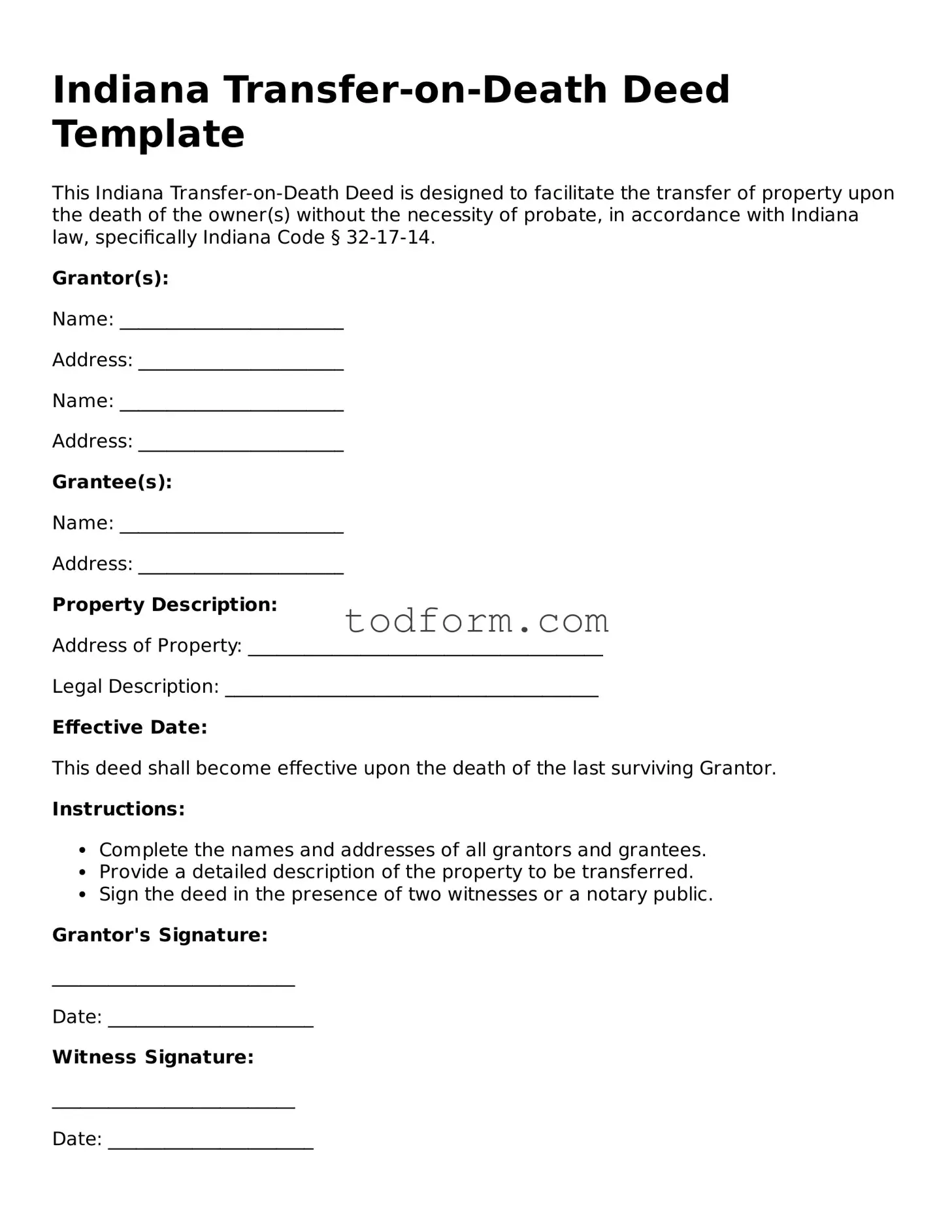

Indiana Transfer-on-Death Deed Template

This Indiana Transfer-on-Death Deed is designed to facilitate the transfer of property upon the death of the owner(s) without the necessity of probate, in accordance with Indiana law, specifically Indiana Code § 32-17-14.

Grantor(s):

Name: ________________________

Address: ______________________

Name: ________________________

Address: ______________________

Grantee(s):

Name: ________________________

Address: ______________________

Property Description:

Address of Property: ______________________________________

Legal Description: ________________________________________

Effective Date:

This deed shall become effective upon the death of the last surviving Grantor.

Instructions:

- Complete the names and addresses of all grantors and grantees.

- Provide a detailed description of the property to be transferred.

- Sign the deed in the presence of two witnesses or a notary public.

Grantor's Signature:

__________________________

Date: ______________________

Witness Signature:

__________________________

Date: ______________________

Notary Public:

State of Indiana

County of _____________________

Subscribed and sworn to before me this _____ day of __________, 20__.

__________________________

Notary Public Signature

My Commission Expires: _______________

Important Note:

This template should be reviewed for legal compliance and signed according to Indiana state laws. Consider consulting with a legal professional if necessary.