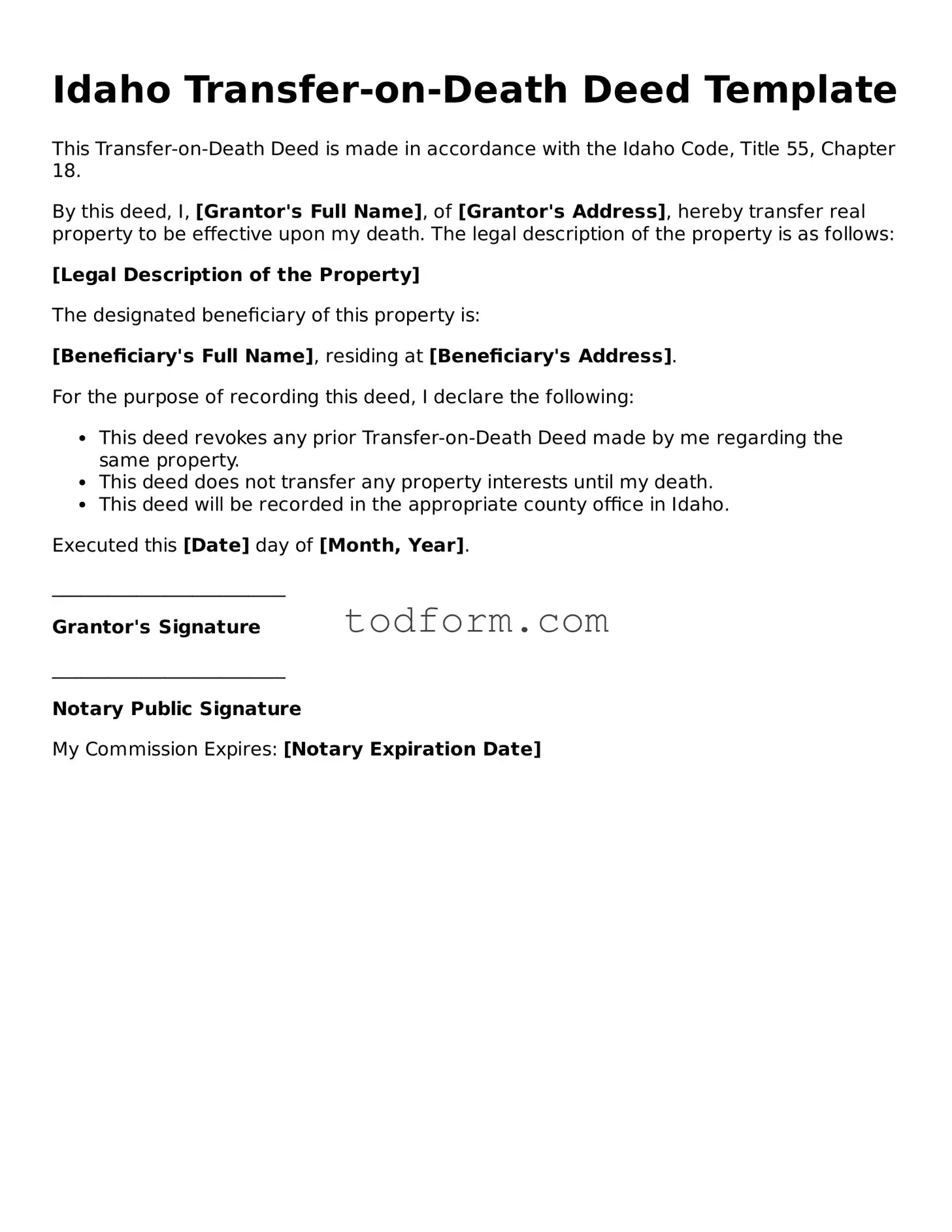

Idaho Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made in accordance with the Idaho Code, Title 55, Chapter 18.

By this deed, I, [Grantor's Full Name], of [Grantor's Address], hereby transfer real property to be effective upon my death. The legal description of the property is as follows:

[Legal Description of the Property]

The designated beneficiary of this property is:

[Beneficiary's Full Name], residing at [Beneficiary's Address].

For the purpose of recording this deed, I declare the following:

- This deed revokes any prior Transfer-on-Death Deed made by me regarding the same property.

- This deed does not transfer any property interests until my death.

- This deed will be recorded in the appropriate county office in Idaho.

Executed this [Date] day of [Month, Year].

_________________________

Grantor's Signature

_________________________

Notary Public Signature

My Commission Expires: [Notary Expiration Date]