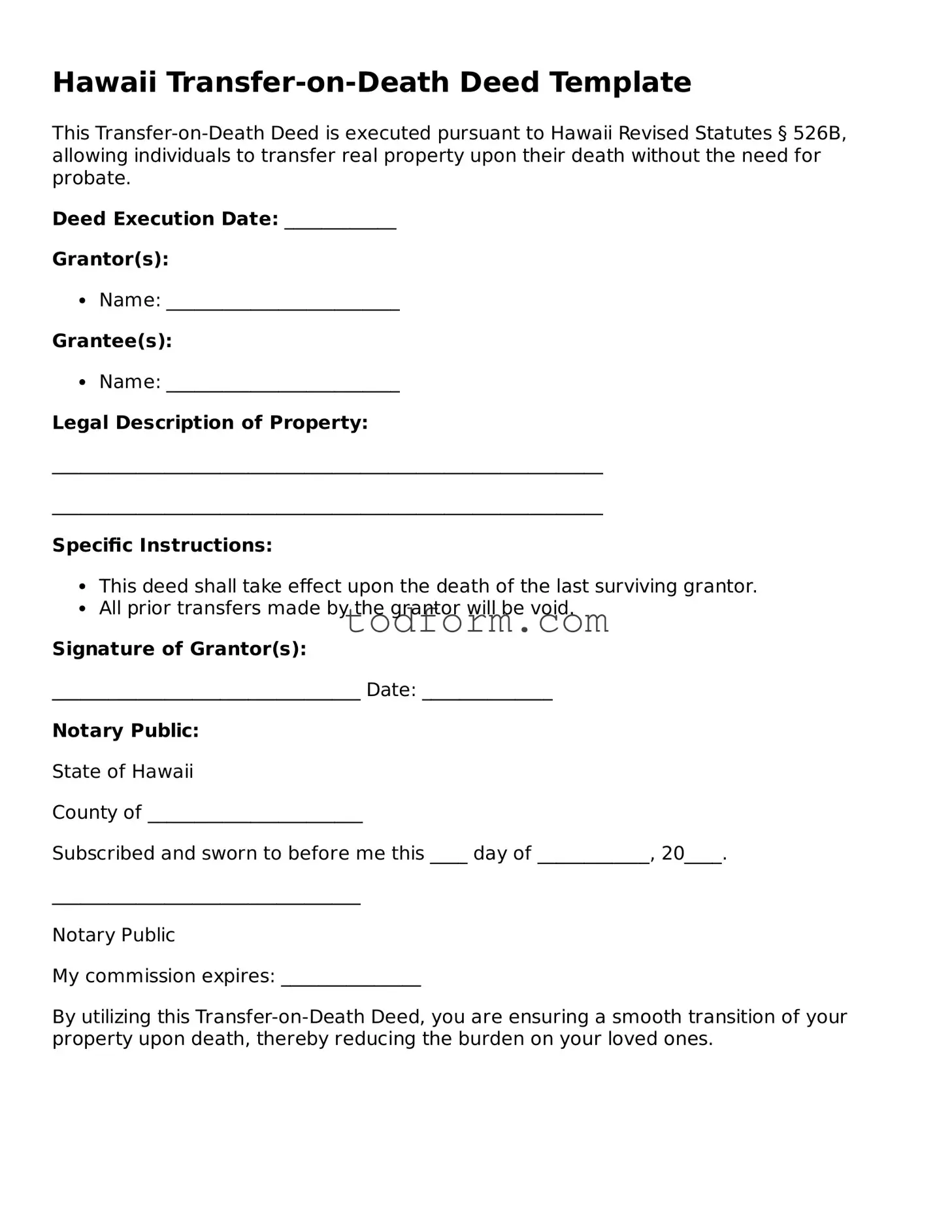

Hawaii Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed pursuant to Hawaii Revised Statutes § 526B, allowing individuals to transfer real property upon their death without the need for probate.

Deed Execution Date: ____________

Grantor(s):

- Name: _________________________

Grantee(s):

- Name: _________________________

Legal Description of Property:

___________________________________________________________

___________________________________________________________

Specific Instructions:

- This deed shall take effect upon the death of the last surviving grantor.

- All prior transfers made by the grantor will be void.

Signature of Grantor(s):

_________________________________ Date: ______________

Notary Public:

State of Hawaii

County of _______________________

Subscribed and sworn to before me this ____ day of ____________, 20____.

_________________________________

Notary Public

My commission expires: _______________

By utilizing this Transfer-on-Death Deed, you are ensuring a smooth transition of your property upon death, thereby reducing the burden on your loved ones.