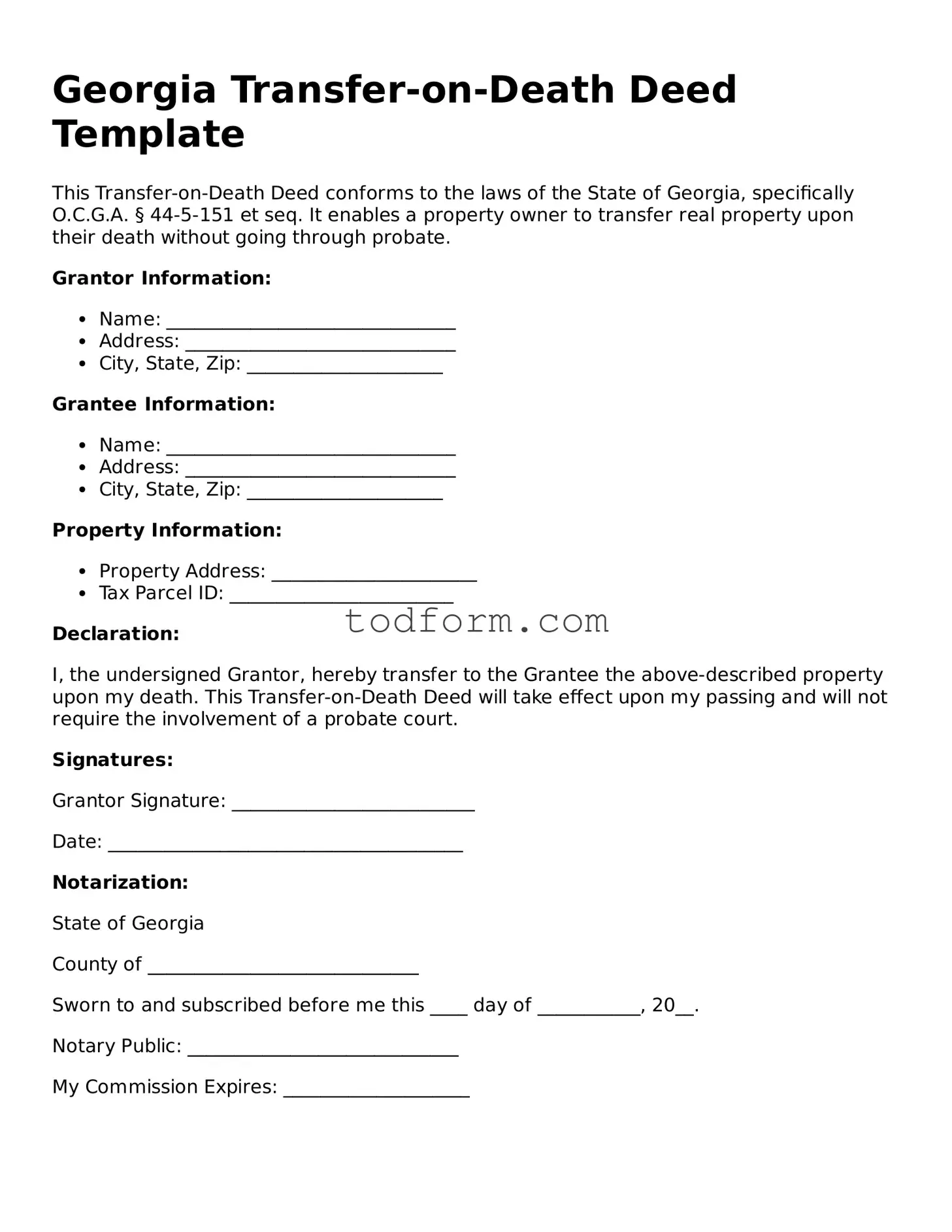

Georgia Transfer-on-Death Deed Template

This Transfer-on-Death Deed conforms to the laws of the State of Georgia, specifically O.C.G.A. § 44-5-151 et seq. It enables a property owner to transfer real property upon their death without going through probate.

Grantor Information:

- Name: _______________________________

- Address: _____________________________

- City, State, Zip: _____________________

Grantee Information:

- Name: _______________________________

- Address: _____________________________

- City, State, Zip: _____________________

Property Information:

- Property Address: ______________________

- Tax Parcel ID: ________________________

Declaration:

I, the undersigned Grantor, hereby transfer to the Grantee the above-described property upon my death. This Transfer-on-Death Deed will take effect upon my passing and will not require the involvement of a probate court.

Signatures:

Grantor Signature: __________________________

Date: ______________________________________

Notarization:

State of Georgia

County of _____________________________

Sworn to and subscribed before me this ____ day of ___________, 20__.

Notary Public: _____________________________

My Commission Expires: ____________________