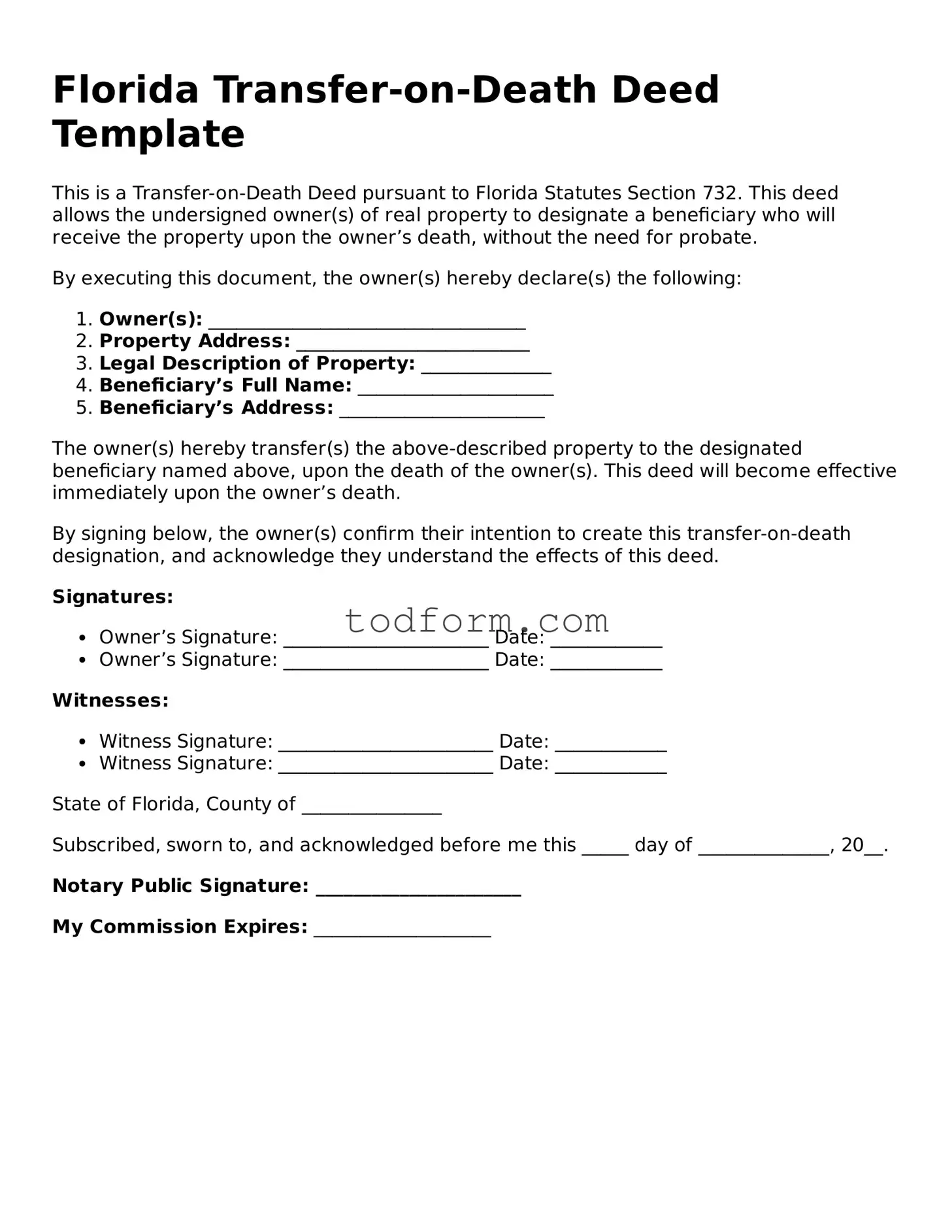

Florida Transfer-on-Death Deed Template

This is a Transfer-on-Death Deed pursuant to Florida Statutes Section 732. This deed allows the undersigned owner(s) of real property to designate a beneficiary who will receive the property upon the owner’s death, without the need for probate.

By executing this document, the owner(s) hereby declare(s) the following:

- Owner(s): __________________________________

- Property Address: _________________________

- Legal Description of Property: ______________

- Beneficiary’s Full Name: _____________________

- Beneficiary’s Address: ______________________

The owner(s) hereby transfer(s) the above-described property to the designated beneficiary named above, upon the death of the owner(s). This deed will become effective immediately upon the owner’s death.

By signing below, the owner(s) confirm their intention to create this transfer-on-death designation, and acknowledge they understand the effects of this deed.

Signatures:

- Owner’s Signature: ______________________ Date: ____________

- Owner’s Signature: ______________________ Date: ____________

Witnesses:

- Witness Signature: _______________________ Date: ____________

- Witness Signature: _______________________ Date: ____________

State of Florida, County of _______________

Subscribed, sworn to, and acknowledged before me this _____ day of ______________, 20__.

Notary Public Signature: ______________________

My Commission Expires: ___________________