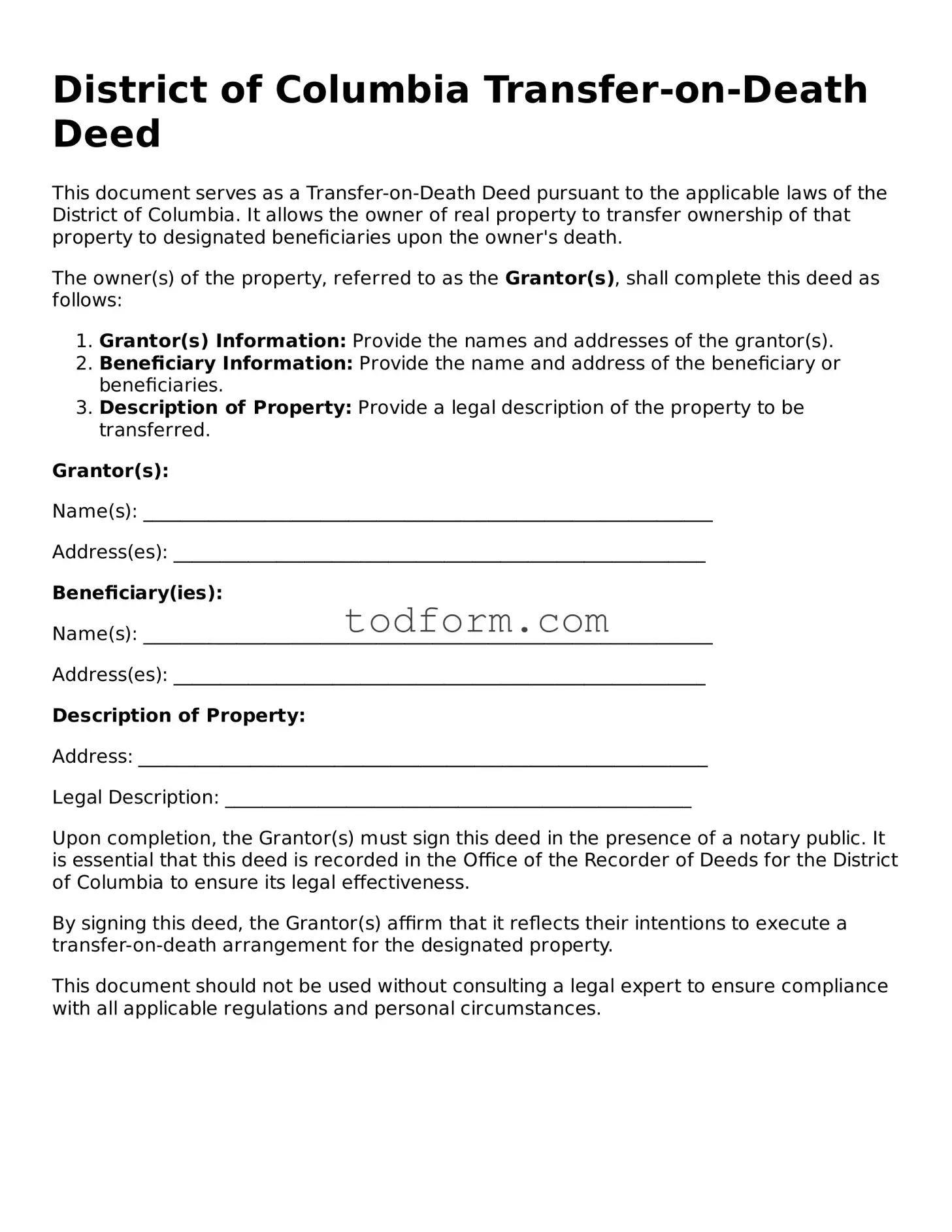

District of Columbia Transfer-on-Death Deed

This document serves as a Transfer-on-Death Deed pursuant to the applicable laws of the District of Columbia. It allows the owner of real property to transfer ownership of that property to designated beneficiaries upon the owner's death.

The owner(s) of the property, referred to as the Grantor(s), shall complete this deed as follows:

- Grantor(s) Information: Provide the names and addresses of the grantor(s).

- Beneficiary Information: Provide the name and address of the beneficiary or beneficiaries.

- Description of Property: Provide a legal description of the property to be transferred.

Grantor(s):

Name(s): _____________________________________________________________

Address(es): _________________________________________________________

Beneficiary(ies):

Name(s): _____________________________________________________________

Address(es): _________________________________________________________

Description of Property:

Address: _____________________________________________________________

Legal Description: __________________________________________________

Upon completion, the Grantor(s) must sign this deed in the presence of a notary public. It is essential that this deed is recorded in the Office of the Recorder of Deeds for the District of Columbia to ensure its legal effectiveness.

By signing this deed, the Grantor(s) affirm that it reflects their intentions to execute a transfer-on-death arrangement for the designated property.

This document should not be used without consulting a legal expert to ensure compliance with all applicable regulations and personal circumstances.