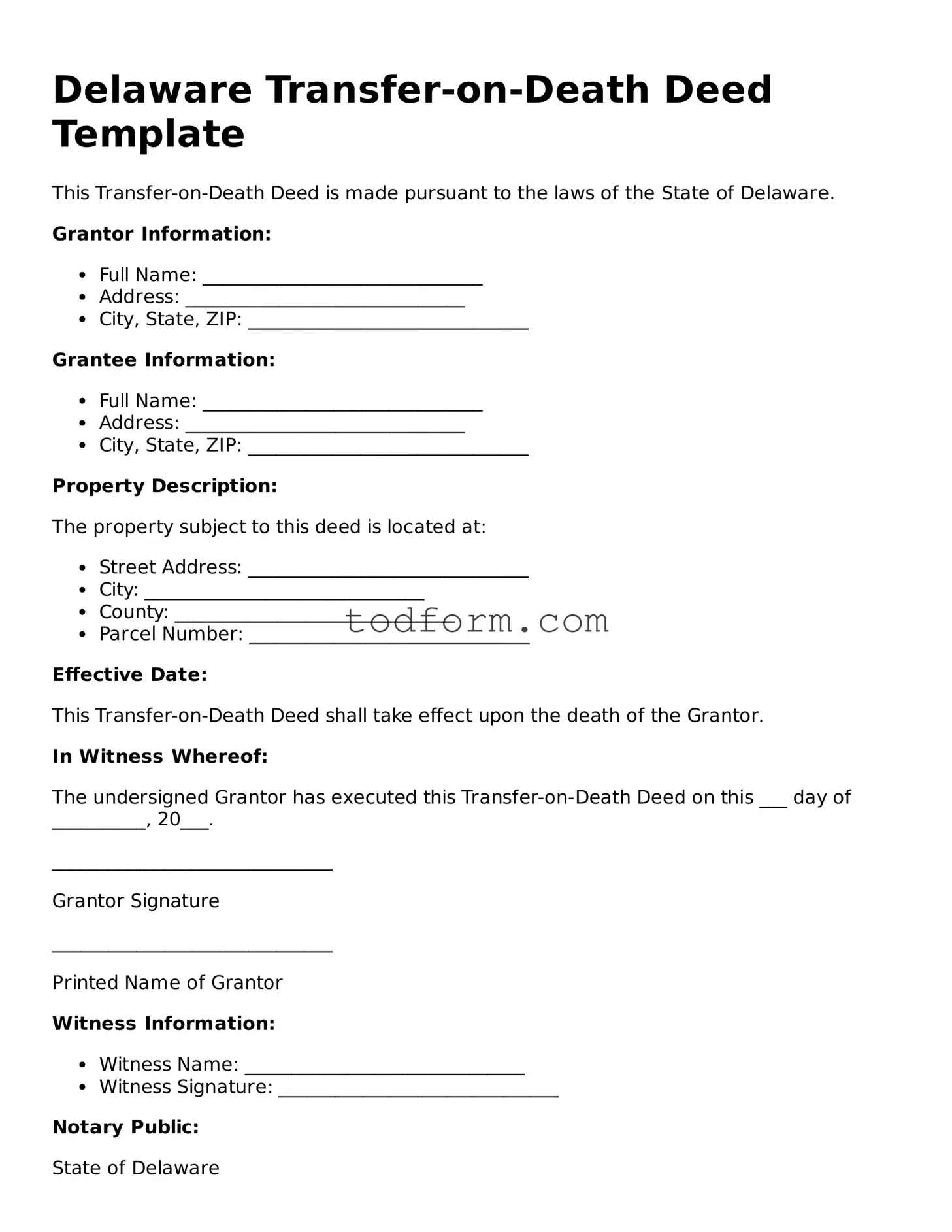

Delaware Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to the laws of the State of Delaware.

Grantor Information:

- Full Name: ______________________________

- Address: ______________________________

- City, State, ZIP: ______________________________

Grantee Information:

- Full Name: ______________________________

- Address: ______________________________

- City, State, ZIP: ______________________________

Property Description:

The property subject to this deed is located at:

- Street Address: ______________________________

- City: ______________________________

- County: ______________________________

- Parcel Number: ______________________________

Effective Date:

This Transfer-on-Death Deed shall take effect upon the death of the Grantor.

In Witness Whereof:

The undersigned Grantor has executed this Transfer-on-Death Deed on this ___ day of __________, 20___.

______________________________

Grantor Signature

______________________________

Printed Name of Grantor

Witness Information:

- Witness Name: ______________________________

- Witness Signature: ______________________________

Notary Public:

State of Delaware

County of _______________

This instrument was acknowledged before me on this ___ day of __________, 20___ by ______________________________ (Grantor).

______________________________

Notary Public Signature

My Commission Expires: ________________