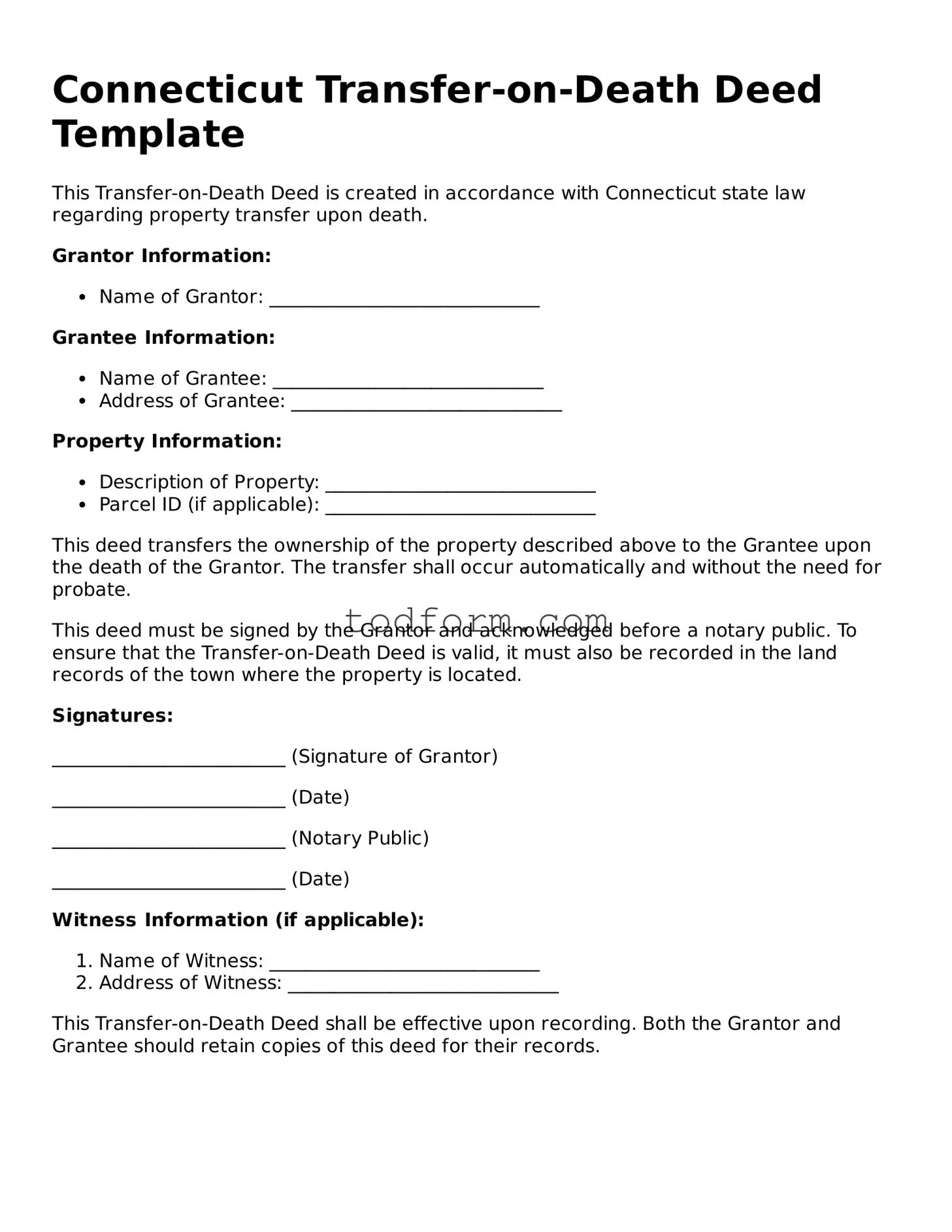

Connecticut Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created in accordance with Connecticut state law regarding property transfer upon death.

Grantor Information:

- Name of Grantor: _____________________________

Grantee Information:

- Name of Grantee: _____________________________

- Address of Grantee: _____________________________

Property Information:

- Description of Property: _____________________________

- Parcel ID (if applicable): _____________________________

This deed transfers the ownership of the property described above to the Grantee upon the death of the Grantor. The transfer shall occur automatically and without the need for probate.

This deed must be signed by the Grantor and acknowledged before a notary public. To ensure that the Transfer-on-Death Deed is valid, it must also be recorded in the land records of the town where the property is located.

Signatures:

_________________________ (Signature of Grantor)

_________________________ (Date)

_________________________ (Notary Public)

_________________________ (Date)

Witness Information (if applicable):

- Name of Witness: _____________________________

- Address of Witness: _____________________________

This Transfer-on-Death Deed shall be effective upon recording. Both the Grantor and Grantee should retain copies of this deed for their records.