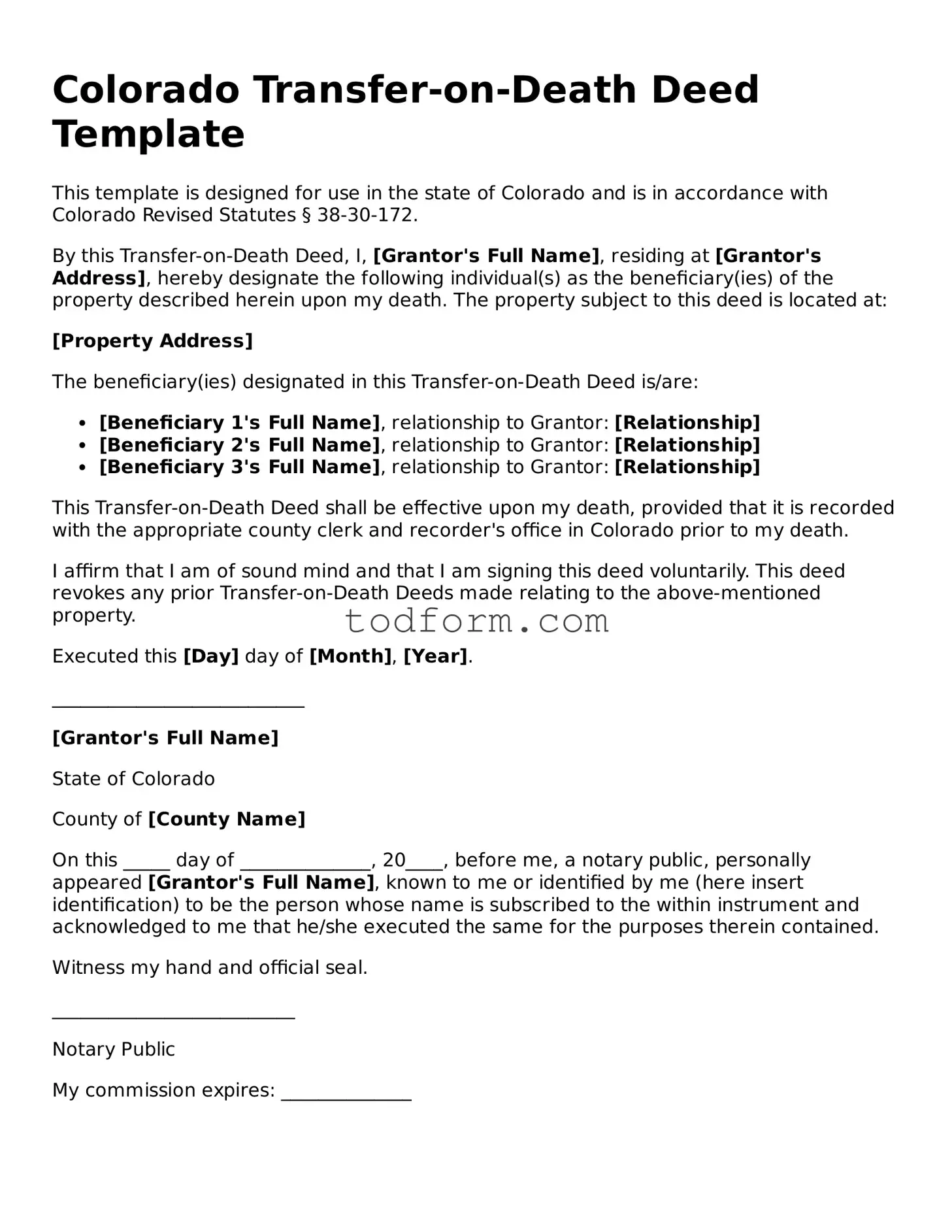

Colorado Transfer-on-Death Deed Template

This template is designed for use in the state of Colorado and is in accordance with Colorado Revised Statutes § 38-30-172.

By this Transfer-on-Death Deed, I, [Grantor's Full Name], residing at [Grantor's Address], hereby designate the following individual(s) as the beneficiary(ies) of the property described herein upon my death. The property subject to this deed is located at:

[Property Address]

The beneficiary(ies) designated in this Transfer-on-Death Deed is/are:

- [Beneficiary 1's Full Name], relationship to Grantor: [Relationship]

- [Beneficiary 2's Full Name], relationship to Grantor: [Relationship]

- [Beneficiary 3's Full Name], relationship to Grantor: [Relationship]

This Transfer-on-Death Deed shall be effective upon my death, provided that it is recorded with the appropriate county clerk and recorder's office in Colorado prior to my death.

I affirm that I am of sound mind and that I am signing this deed voluntarily. This deed revokes any prior Transfer-on-Death Deeds made relating to the above-mentioned property.

Executed this [Day] day of [Month], [Year].

___________________________

[Grantor's Full Name]

State of Colorado

County of [County Name]

On this _____ day of ______________, 20____, before me, a notary public, personally appeared [Grantor's Full Name], known to me or identified by me (here insert identification) to be the person whose name is subscribed to the within instrument and acknowledged to me that he/she executed the same for the purposes therein contained.

Witness my hand and official seal.

__________________________

Notary Public

My commission expires: ______________