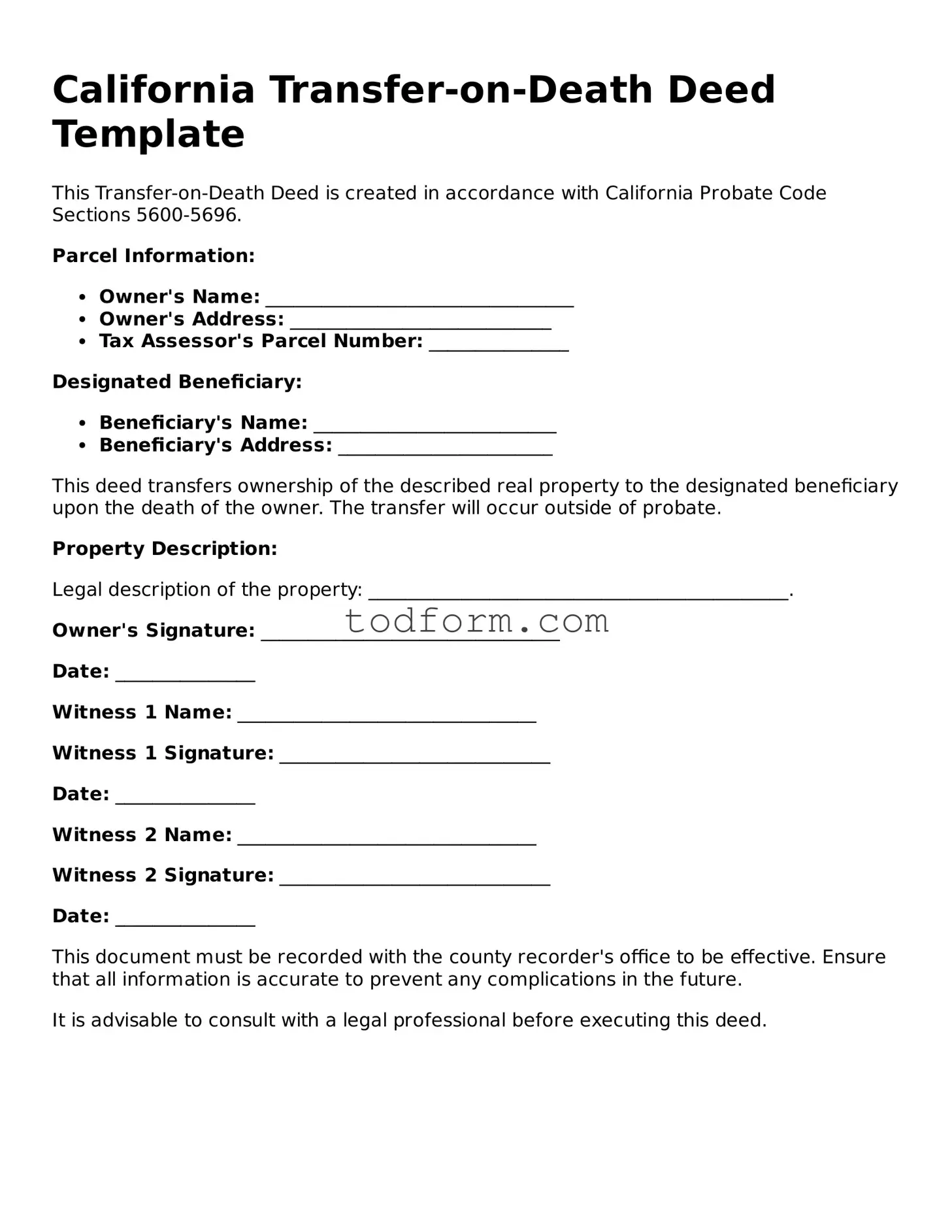

California Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created in accordance with California Probate Code Sections 5600-5696.

Parcel Information:

- Owner's Name: _________________________________

- Owner's Address: ____________________________

- Tax Assessor's Parcel Number: _______________

Designated Beneficiary:

- Beneficiary's Name: __________________________

- Beneficiary's Address: _______________________

This deed transfers ownership of the described real property to the designated beneficiary upon the death of the owner. The transfer will occur outside of probate.

Property Description:

Legal description of the property: _____________________________________________.

Owner's Signature: ________________________________

Date: _______________

Witness 1 Name: ________________________________

Witness 1 Signature: _____________________________

Date: _______________

Witness 2 Name: ________________________________

Witness 2 Signature: _____________________________

Date: _______________

This document must be recorded with the county recorder's office to be effective. Ensure that all information is accurate to prevent any complications in the future.

It is advisable to consult with a legal professional before executing this deed.