Fill Out Transfer-on-Death Deed Now

Fill Out Transfer-on-Death Deed Now

Attorney-Verified Transfer-on-Death Deed Form

A Transfer-on-Death Deed is a legal document that allows an individual to transfer real estate property to a designated beneficiary upon their death, bypassing the probate process. This form provides a straightforward way to ensure that your property is passed on according to your wishes without the complications often associated with estate management. For those interested in securing their property for future generations, filling out this form is a crucial step; click the button below to get started.

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Similar forms

The Transfer-on-Death (TOD) Deed is similar to a Last Will and Testament in that both documents allow individuals to dictate how their property will be distributed upon their death. A Last Will and Testament provides a comprehensive plan for the distribution of assets, appoints guardians for minor children, and names an executor to manage the estate. However, unlike a will, a TOD Deed does not go through probate, allowing for a more straightforward transfer of property directly to the designated beneficiaries upon the owner's death.

Another document that resembles the Transfer-on-Death Deed is a Living Trust. A Living Trust allows individuals to place their assets into a trust during their lifetime, which can then be distributed to beneficiaries after their death. Like the TOD Deed, a Living Trust avoids probate. However, a Living Trust can provide more extensive management of assets while the individual is still alive, offering flexibility for those who may wish to retain control over their assets or provide for their care in case of incapacity.

The Beneficiary Designation form shares similarities with the Transfer-on-Death Deed, as both allow individuals to name beneficiaries who will receive specific assets upon their death. Commonly used for bank accounts, retirement accounts, and insurance policies, beneficiary designations can be simpler than a TOD Deed. They automatically transfer ownership to the named beneficiaries without the need for probate, making them an efficient way to ensure that assets are passed on according to the owner's wishes.

Joint Tenancy with Right of Survivorship is another legal arrangement that functions similarly to a Transfer-on-Death Deed. In this arrangement, two or more individuals own property together, and upon the death of one owner, the surviving owner(s) automatically inherit the deceased owner's share. This arrangement bypasses probate, much like a TOD Deed. However, joint tenancy can create complications if one owner wishes to sell their share or if there are disputes among joint owners.

A Payable-on-Death (POD) account is akin to a Transfer-on-Death Deed in that it allows for the direct transfer of funds to a designated beneficiary upon the account holder's death. This type of account is commonly used for bank accounts. The funds in a POD account do not go through probate, ensuring a swift and straightforward transfer to the named beneficiary. However, unlike a TOD Deed, which applies to real property, a POD account is limited to financial assets.

Life Estate Deed is another document that bears similarities to the Transfer-on-Death Deed. A Life Estate Deed allows an individual to retain the right to use and benefit from a property during their lifetime while designating a beneficiary who will inherit the property after their death. This arrangement can help avoid probate, similar to a TOD Deed. However, the key difference lies in the fact that the original owner cannot sell or mortgage the property without the consent of the beneficiary.

A Revocable Living Trust is closely related to the Transfer-on-Death Deed, as it allows individuals to maintain control over their assets while designating beneficiaries. Like a TOD Deed, a Revocable Living Trust bypasses probate, allowing for a smoother transfer of assets upon death. The main distinction is that a Revocable Living Trust can be altered or revoked during the grantor's lifetime, providing flexibility that a TOD Deed does not offer.

Finally, a Durable Power of Attorney can be compared to a Transfer-on-Death Deed in terms of designating a person to manage affairs. While a TOD Deed specifically addresses the transfer of property upon death, a Durable Power of Attorney grants someone the authority to make financial or legal decisions on behalf of an individual while they are still alive. This document is crucial for situations where an individual may become incapacitated, but it does not directly address the transfer of property after death.

Sample - Transfer-on-Death Deed Form

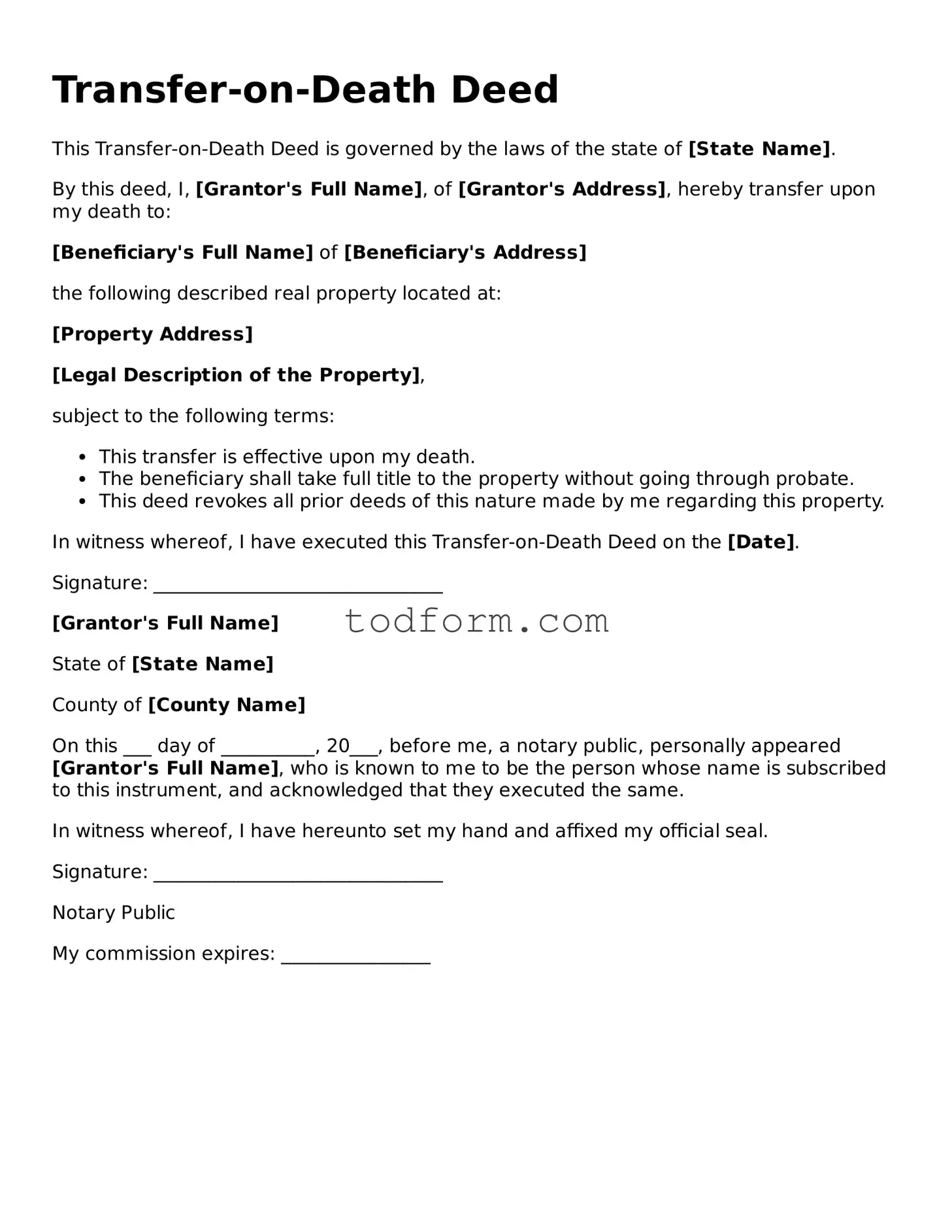

Transfer-on-Death Deed

This Transfer-on-Death Deed is governed by the laws of the state of [State Name].

By this deed, I, [Grantor's Full Name], of [Grantor's Address], hereby transfer upon my death to:

[Beneficiary's Full Name] of [Beneficiary's Address]

the following described real property located at:

[Property Address]

[Legal Description of the Property],

subject to the following terms:

- This transfer is effective upon my death.

- The beneficiary shall take full title to the property without going through probate.

- This deed revokes all prior deeds of this nature made by me regarding this property.

In witness whereof, I have executed this Transfer-on-Death Deed on the [Date].

Signature: _______________________________

[Grantor's Full Name]

State of [State Name]

County of [County Name]

On this ___ day of __________, 20___, before me, a notary public, personally appeared [Grantor's Full Name], who is known to me to be the person whose name is subscribed to this instrument, and acknowledged that they executed the same.

In witness whereof, I have hereunto set my hand and affixed my official seal.

Signature: _______________________________

Notary Public

My commission expires: ________________

Misconceptions

Understanding the Transfer-on-Death Deed (TODD) form is crucial for effective estate planning. However, several misconceptions can lead to confusion. Here are seven common misconceptions about the TODD form:

- It only applies to real estate. Many believe that the TODD is limited to real estate. In reality, it can also be used for other types of property, depending on state laws.

- It automatically transfers all assets upon death. Some think that signing a TODD means all assets will transfer immediately after death. In fact, it only transfers the specific property listed in the deed.

- It is irrevocable once signed. There is a belief that once a TODD is executed, it cannot be changed. However, the owner can revoke or alter the deed at any time before death.

- It avoids probate for all assets. Many assume that using a TODD will prevent probate for all assets. While it does avoid probate for the property specified, other assets may still go through probate.

- It is only beneficial for large estates. Some think that TODDs are only useful for high-value estates. In truth, they can be beneficial for anyone looking to simplify the transfer of property.

- Beneficiaries must accept the transfer. There is a misconception that beneficiaries are obligated to accept the property transferred via a TODD. Beneficiaries can choose to decline the property if they wish.

- It requires court approval. Many believe that a TODD needs court approval to be effective. This is not true; the deed takes effect automatically upon the owner's death without court intervention.

Addressing these misconceptions is vital for making informed decisions regarding estate planning. Always consult with a qualified professional to ensure that your estate planning strategies align with your goals.

Listed Questions and Answers

-

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD deed) is a legal document that allows you to transfer ownership of real estate to a beneficiary upon your death. This deed enables you to keep full control of your property while you are alive, and it avoids the probate process for the beneficiary after your passing.

-

How does a Transfer-on-Death Deed work?

When you create a TOD deed, you name a beneficiary who will receive the property after your death. You continue to own the property during your lifetime and can sell or change the deed if necessary. Upon your death, the property automatically transfers to the named beneficiary without going through probate.

-

What are the benefits of using a Transfer-on-Death Deed?

There are several advantages to using a TOD deed:

- No probate: The property transfers directly to the beneficiary, avoiding the lengthy probate process.

- Control: You maintain full control over the property while you are alive.

- Flexibility: You can revoke or change the deed at any time before your death.

-

Are there any limitations to a Transfer-on-Death Deed?

Yes, there are some limitations. A TOD deed typically only applies to real estate and not personal property. Additionally, the beneficiary must survive you for the transfer to occur. If the beneficiary predeceases you, the property may not transfer as intended unless alternate beneficiaries are named.

-

How do I create a Transfer-on-Death Deed?

To create a TOD deed, you need to fill out the appropriate form for your state, which usually includes your name, the property description, and the beneficiary's information. Once completed, the deed must be signed and notarized. Finally, you must record the deed with your local county recorder’s office to ensure it is legally recognized.

-

Can I revoke a Transfer-on-Death Deed?

Yes, you can revoke a TOD deed at any time while you are alive. To do this, you should create a new deed that explicitly revokes the previous one or record a formal revocation document with the county recorder’s office. Always ensure that the revocation is properly documented to avoid any confusion later.